How Non-Americans Can Sell Their Products on Amazon FBA

This blog tends to attract a lot of international readers, and one of the most common questions I get is from non-Americans asking how they can sell their imported and private label products in the United States. Readers are eager to access the more than 330 million consumers in the states, and understandably so—the American ecommerce market is huge.

This happens to be a question I am well versed in answering as I live in Vancouver, Canada, and the vast majority of our company's sales are in the US. Almost all of the products we import are warehoused in the US. And no, I do not have a US corporation or some other fancy legal workaround. (I give a more detailed account of how to get started doing business in the United States in our Importing Course.) However, this article will give you a great start on the basics you need to know to start selling in the United States.

Also, let me give the necessary disclaimer and say that I am not a lawyer or a customs broker, so please consult these professionals before relying on the information I outline here.

Common Misconceptions

To begin, let me address a few common misconceptions about non-Americans importing into America.

FALSE: I need to open a US company to ship and sell my goods from the United States

If you are simply shipping your goods to the United States to have another company fulfill them (e.g., Amazon FBA), you do not need to have a US company. Lobbing your goods into some US warehouse to be shipped to Americans is easy. The need to have a US company becomes an issue when you start wanting to work in the United States or employ people there.

If you're Canadian check out our article on the best business structure for Canadian ecommerce businesses.

FALSE: I need an EIN (or W-EIN) to import into the United States

To make a formal entry into the United States (a shipment over $2,500) you need either a Social Insurance Number, EIN, W-EIN, OR a Customs Assigned Number. Thus, there's no need for an EIN or W-EIN if you have the Customs Assigned Number.

The Customs Assigned Number is for people who don't have a social insurance number or EIN. You can fill out this form or, if you're using a customs broker, they will get this assigned number for you and charge you nothing or very little to get it for you. Again, if your shipment is under $2500, you do not have to worry about this.

FALSE: I need to pay US income tax if I sell my goods in the United States

Simply selling your goods in the United States does not normally require you to pay US income tax. There's something called ETBUS (Engaged in Foreign Trade or Business in the US). To be considered ETBUS, you need to meet the following requirements:

- Have at least one dependent agent in the United States. A dependent agent is one who works so closely with you that his or her actions can be considered yours.

- That dependent agent should be furthering your business in the United States, i.e., the job is not limited to admin tasks).

You will be required to pay US income tax if you are ETBUS. But if you have no employees, you're almost certainly not ETBUS.

You will, however, have to pay sales tax in any state your products are stored (which would be 0% if you store them in a state like Oregon with no sales tax) and you can easily register, even as a foreigner, to pay sales tax with local state authorities.

How to Ship Your Goods to Amazon

So once you have your product that you want to sell, how do you get them to Amaozn fulfillment centers?

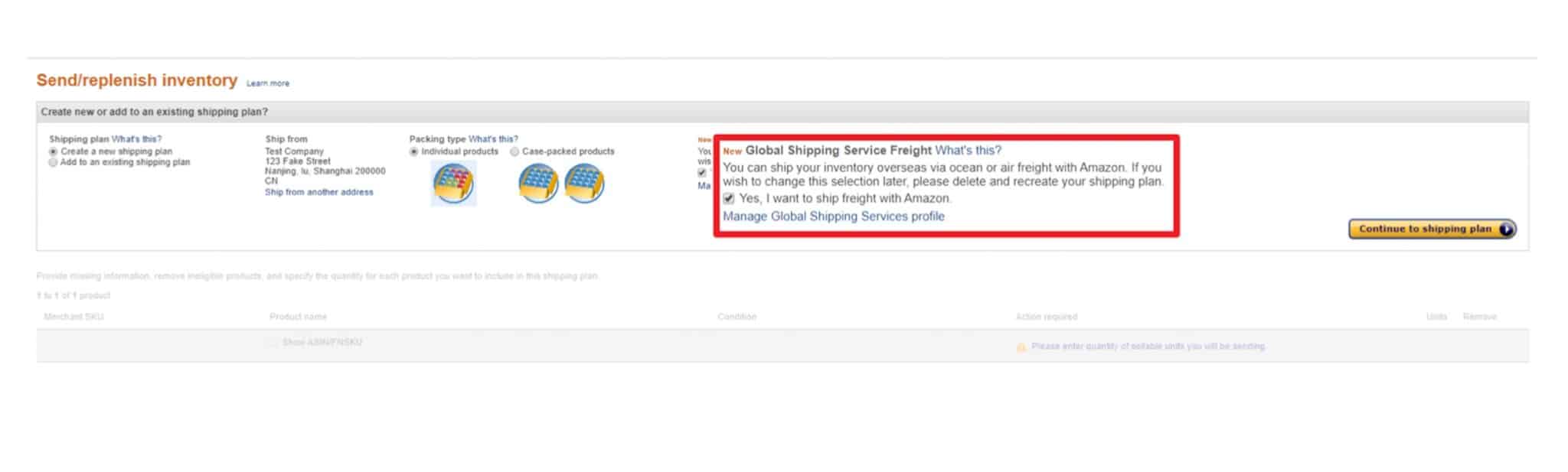

If you're shipping your goods from China to Amazon fulfillment centers in the U.S. the easiest way is through Amazon's freight forwarder (a fancy word for shipping company) called Amazon Global Logistics. See our article on how to use Amazon Global Logistics. With Amazon global logistics, Amazon will handle the sea freight (or air freight) along with customs brokerage. Customs brokerage just means the company that arranges to pay the duties you owe when you import something into the United States. Typically these duties are 0% to 50%.

Amazon Global Logistics really only works if you're importing from China. If you're purchasing your products from somewhere else, for example, if you're purchasing products from Canada and sending them into Amazon.com warehouses, then you'll need to arrange your own shipping. Amazon can't help you.

You either need to use a freight forwarder if you're shipping lots of stuff (Freightos.com is a good choice) or via a ‘small parcel carrier' like UPS, FedEx, Canada Post, etc.

No matter how you ship your products, the big key is to ensure that you ship them to Amazon with all duties paid. For example, if you've ever bought something from another country and had it shipped to you then you know that often you'll get a bill for any outstanding taxes and duties. You don't get the product until you pay those duties. Well, if you ship to Amazon and they get a bill, guess what? They ain't gonna pay it for you. The technical term for this is you're shipping to Delivery Duty Paid (DDP).

If you're shipping via UPS or FedEx you need to make sure you select this option to have the duties paid to you and not Amazon. This is pretty tricky to figure out but it is possible to do. There is good news though – as long as the goods are under $800 in value, there shouldn't be any duties or taxes. If they're over $800 there will be. This is called the ‘de minimis threshold‘. Remember that $800 number. It's very important.

How to See How Much Your Competitors Are Importing from China

Want to see how much your competitors are importing from China?

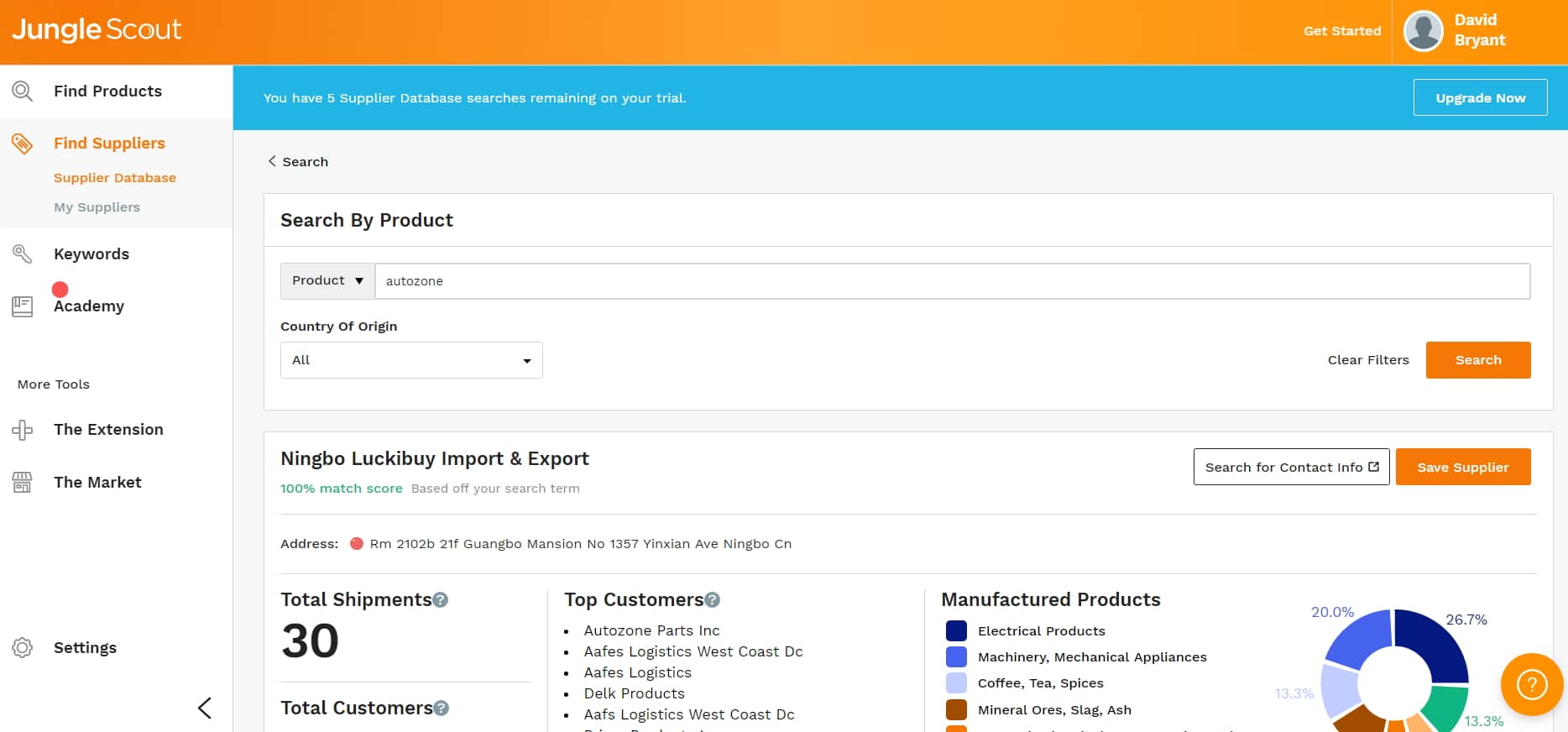

Custom import records are public information in the United States and there are multiple tools that allow you to simply search for a company name and see exactly how much these companies are importing from China.

My favorite tool for this is Jungle Scout's Supplier Database tool which costs less than $50 a month (other more expensive options include Import Genius and Panjiva). These tools will neatly summarize all of the information included on a particular company's Bill of Lading information such as product type, quantity, and supplier name/address.

If you're shipping via sea freight, you're going to need to setup a customs broker account regardless which will make sure you get billed the duties. If you're using Amazon Global Logistics they'll set this up for you automatically. If you're using someone like Freightos.com they'll give you the option to setup a Customs Broker account when you create your account.

A Sneaky Hack for Canadians to Get U.S. UPS & USPS Rates

This one only applies to Canadians. You know that, thanks to the border, shipping anything to the US is ridiculously expensive. However, there are a number of cross-border carriers that will ship your goods from Canada to the US at the domestic United States USPS or UPS rates (plus a small handling fee of $1 to $5). These carriers will pick up your packages in Canada and then drop them off at a postal facility across the border. An example of one of these carriers is Stallion Express.

However, note that this only applies to orders under $800, and this service is restricted to regions geographically close to the US (Vancouver, Toronto, and Montreal all have these services).

Taxes, Legal Requirements, and Money

The biggest headache for sellers used to be Sales Tax as technically you, the seller, would be responsible for collecting sales tax in 40+ states.

Over the last few years, this has all changed and Amazon is the one collecting and remitting sales tax in almost all states. There's exceptions, I'm not an accountant or lawyer, check with your CPA etc etc. but, for what it's worth, the vast majority of sellers do not collect/remit sales tax and leave it up to Amazon.

In terms of income tax, simply shipping your goods from a U.S. warehouse does not normally make you a U.S. company. Therefore, you should not have to pay any Federal Income Tax. Also, the United States has tax treaties with a lot of countries which will likely make you “exempt from U.S. taxes on certain items of income [you] receive from sources within the United States”. Technically, you should file a Form 1120-F with the IRS, which basically tells the IRS “Hey, I sold some stuff in the US. but I'm not paying tax because I'm a foreign corporation.” Again, like with FBA, a good portion of foreigners never file this, although when your revenues get to be substantially large (I'll leave it for an accountant to deem what he or she considers substantially large) you should consider filing such a form.

Money and US Bank Accounts

Amazon allows sellers from most countries to link their local bank account to their Seller Central account and get paid directly into that bank account. And no, it doesn't need to be a business bank account- Amazon will can be any personal bank account. There's good reasons to have a business bank account, but Amazon themselves do not care.

Note that Amazon will convert any money into your local currency. So if your bank account is based in Canada they will convert all of your U.S. sales to Canadian dollars. It does not matter if you have a “US dollar account” in your home country, Amazon will still convert the funds. You might wonder why this matters. It matters because if you have suppliers who you pay in U.S. dollars (i.e. Chinese suppliers) you lose a lot of money converting money from USD on Amazon to CAD in Canada back into USD in China (it's about 10% you'll lose in all the currency conversion fees you'll pay each time).

In this case, you ultimately need a bank account “in the United States”. Again, we are not talking a US Dollar account in Canada – the bank physically needs to be in America. Services like Wise.com can help. If you're Canadian, you can open up a US based bank account at TD/RBC/BMO through one of their subsidiaries and normally online. For other countries, it's a little more complicated but there are options.

Conclusion

One of the strengths of the American economy is how easy they make it for both its citizens and foreigners to do business in their country. For importers looking to sell into the largest economy in the world, this article should give you a good starting point for selling in the United States.

Are you a foreigner selling in the United States? What have your experiences been? Please comment below.

Interesting, as we all the time do importing and exporting in China there is always some points that need pointed out such as in the article, however rules changes from time to time so one must beware to see the current situation. Curerncy, development of country etc can affect importing from China.

Yes- currency is a big one to always be aware of (I knew of a number of European companies who got hit big time a few years ago). That’s the beauty of selling in the U.S. though – you pay your Chinese Suppliers in U.S. dollars, and you get your revenues in U.S. dollars, so there’s minimal currency risk.

Dear Bryan, When it comes to opening bank accounts in the USA, foreigners cannot do that unless they form a LLC or any type of corporation in the US(Incorporate), get their EIN # and go to the U.S.(physically, in person) present their ids( passoport, visa, LLC corporation papers and all that) then they might be able to open an account, otherwise forget it. Many claim that it is possible to open ‘online’, etc. but this does not apply. Your case is different because Canada and the U.S. they have agreements and it’s easier for Canadians to do business and travel inside the U.S territory once both countries do not differ very much culturally speaking inclunding the language. This is my personal opinion. Elder – BRAZIL

Hi,

There’s definitely a need to prove your identity (normally involving going to a branch) but you can open a personal account without an EIN or LLC (or SIN)

Not true.

I am a Canadian, and have opened both a BMO Harris personal account by phone, and an RBC USA business account by going into my local Canadian RBC branch.

Do you still need to open a US bank account if your current one has a branch there? For instance Santander have a branch in US and I have an account here in the UK with them but its in GBP so I would get 2% taken off still on the exchange? Is that also the same with paypal?

Yes, you still probably need a US account. Santander’s “branch” in the US is NOT a bank, it is a sales or “representative” office. Santander may own a bank in the US but it is not the same company as the Spanish one. This is a very easy point to misunderstand. The US government simply doesn’t want anyone, personally or as a corp or llc, to be able to open a US account without walking into a US licensed bank and showing proof of US address. You can operate on Amazon with an non-US account, of course. This article is very accurate, by the way. Best I’ve ever seen!

Thanks for the great advice Richard!

You are no longer required to have a us bank account. Amazon.com will deposit money into your Canadian bank account. This is a new development, but definitely worth mentioning.

Yes, I realize I should have clarified in the article. Amazon will deposit into a foreign bank account in that country’s home currency. The problem is, they take around a 3% hair cut off the exchange rate. Chinese Suppliers are paid in USD, and when you exchange back from your home currency to USD you’ll lose another 1.5-3%. All in all, you lose around 5% (assuming you ultimately need your Amazon earnings in USD).

Hi David. Did you manage to find out whether you can open a US account without being there? I have spoken to Amazon and they said you can send from say, US in USD to UK in USD, although they’ve been wrong before. All the other banks I’ve tried require me to actually be there. The other option is to use a currency broker who will open the account, but they will still take a percentage off you.

Hi Matt,

All I know for sure is that I, as a Canadian, was able to open a BMO Harris account (in the US) without being there. They can send USD to your UK bank, but they will convert it to pounds when they send it. There’s no way to send to any non-US bank account (USD or not) in USD. https://sellercentral.amazon.com/forums/thread.jspa?threadID=268822

Non- U.S. residents can use the service of Payoneer.com that has partnered with Amazon to solve this problem. All you have to do is sign up Payoneer.com and follow the instructions on the website. It’s called disembursement from Amazon or third-parties companies. Thanks

Good share! Are you currently using Payoneer?

I’ve been using Wise (formerly TransferWise) for having a US Bank Account

Hi David,

Asides from the challenges of a smaller market, do Canadian shipping costs make importing from China and selling in Canada worthwhile? And if you wish to sell in the US, is it economically feasible to ship from Canada?

Hi Mike,

Shipping with Canada Post isn’t terrible, although higher than the States. You might consider sending all of your stuff to FBA Canada to be fulfilled – they will likely get a better rate than you. If you’re Canadian I would definitely recommend getting your feet wet with the Canadian market to begin with.

The shipping costs with Canada Post to the U.S. are surprisingly competitive with rates from within the U.S.- there’s been many times we pay only a few more dollars shipping an item from Canada to the U.S. than U.S. to the U.S.. The biggest obstacle is the longer transit times, potential customs delays, and potential taxes/duties the American customer on the end will incur. Again, I would get my feet wet and ship from Canada to the U.S. before setting up any U.S. fulfillment. If you’re doing well, then setup U.S. fulfillment :)

David,

Thank you so much for your reply. I truly appreciate your insight!

If you ship a lot to the USA, DHL has competitive rates and is usually quicker than USPS considering it has to cross border

Yep, DHL can be great, especially if you negotiate lower rates.

Very useful information. I am looking some information how to ship goods from China to US FBA as a Canadian resident (I immigrated to Canada from China :)). So basically I need to do is to send a small test shipment from China to US FBA directly, right?

Hi Lory,

You can do this but you must be veryyy careful to ensure there are no fees (specifically, duties) will be charged to Amazon upon delivery. Other wise, Amazon will reject the shipment and send it back to China.

If you purchase the book right now you get a free copy of “How foreigners can do business in the USA” which is basically written from the perspective of a Canadian doing business in the USA. I’m biased, but it’s worth the $9.99 :) http://www.chineseimporting.com/china-ebook/

Hi David,

Thank you. I just purchased the book and shall read it first. If any questions, I will let you know.

Lory

Hi David,

This link is not working, are you able to re-share this? I’m a Canadian looking to send a shipment to Amazon US (FBA) from Canada and need some guidance.

I notice this question is 5 years before, but I am the same situation with you now. I can’t find the book with the link. How do you solve these problems: a Canada PR ship goods from China to Amazon US?

Could you send to my email: gavintian70@outlook.com, I’m appreciate it.

Thanks.

My understanding is that you absolutely must be physically present in a US bank to open an account. Not a problem for most Canadians but a big one for others living further away. Those selling on Amazon can receive payments through Payoneer or Amazon itself will pay in large countries (like Canada) but not smaller, poorer ones.

Hi Richard,

I’ve heard that too. But with that being said, I recently opened up a BMO Harris bank account, without ever going to the U.S.- I did it all via emails. I’ll try and see if I can find a definitive answer to this at some point.

Hi David,

Any idea how it might work for someone based in Europe (France, or the UK), in terms of setting up a bank account to eventually work with an US-based FBA?

Thanks, Harriet

I’d suggesting contacting a bank with branches in the U.S. link HSBC. Other than that, you can use your Europe based bank account, you just get killed on exchange fees

Hey David,

As far as I know that unfortunately only applies to Canadian’s.

Most Canadian Banks have subsidiaries only in the U.S (TD/BMO/RBC)

which makes it easier. Even though there are Banks operating internationally like HSBC, CITI… these don’t compare.

Hi David,

I stumbled upon your site by accident and I’m so glad I did. You provide a wealth of valuable info. There’s not much info out there for Canadians wanting to send to US FBA.

I reached out to Amazon regarding the Consignee’s tax ID and they told me that they will only provide the tax id on shipments that need a formal clearance through US customs. If the shipment doesn’t require a formal clearance through US customs, then I would need to work with my carrier to set up an Importer Number.

I will be receiving my product from China soon and was planning to ship my product to the US warehouses via UPS or FedEx Ground (I live in Toronto).

Do you have any insight on formal clearances and shipping inventory through one of these carriers? What kind of steps are required to clear customs and what kind of info will I need ahead of time? I was hoping to just let the carrier deal with the custom clearance but sounds like I might need to take additional steps before shipping my product out…

Any insight would be greatly appreciated!

Hi Ryan,

Are you shipping your products to Toronto or FBA USA first?

Formal clearance in the U.S. is only required for shipments over $2500. Typically, if something is being shipped via UPS or FedEx it requires no formal clearance. If you’re using FedEx/UPS’ broker, chances are the only thing you’re going to need for customs clearance is a credit card and a name :)

With that being said, be very careful if trying to send products directly from China to FBA USA (see the warnings in this article)

Thanks for the prompt response David! I will be shipping product from China to Toronto and then to warehouses in the US.

This will be my first shipment so I want to keep things super simple and just get the bare minimum required to get my product to the warehouse and start selling. There seems to be so many roadblocks in the way and I’m trying to minimize the amount of unnecessary work if possible.

If I’m reading your message right, would I only need an EIN if I’m shipping product that’s valued over $2500 (i.e. require formal clearance)? Would I need to fill out a commercial invoice or waybill or something to give to UPS/FedEx? I was hoping for them to deal with the shipping, brokering/customs etc and I’m just unsure of what is needed in terms of administrative requirements.

Hi Ryan,

OK good- I definitely recommend getting shipped to Toronto first and then ship a small trial to Amazon FBA in the USA. And no, for shipments over $2500 you need to make a formal clearance, which involves a bit more paperwork and usually a broker, but not an EIN (long story short- over $2500, just use a customs broker and they’ll walk you through it). There should be an interview going live in a couple of weeks with a customs broker which will have a lot more info on this subject.

Doing business in the U.S., especially as a Canadian, is extremely easy. Not to pump my own book, but for $9.99 you get the Chinese Importing Book and How Foreigners Can Do Business in the USA book here. It’s Amazon that can be a bit of pain- but even then, it’s not terrible- just try to make your first shipment to FBA USA small so you keep your losses at a minimum if something goes astray.

I’m a bit surprised by this. If you ship to Toronto first and then to the US, aren’t you paying duty twice (first to Canada, then to the US)?

You can have it in bond in Canada so you don’t have to pay any duties or taxes if it’s in transit to another location.

thanks – this answers a question I posted in another article on this site. Glad I found this article.

Hi David,

Thank you for the great article, could you recommend a good freight forwarder or courier to ship from Toronto to Amazon US FBA center?

Thank you.

Tao

Hi Tao,

There’ll be an interview with Pacific Customers Brokers who also has a freight forwarding division (PCB.ca). They’ve handled my shipments in the past, so you might try them out.

Hi David, Thanks for this valuable information, My question is do you think it is a good idea in the first place to have your Asian supplier ship your items directly to FBA USA, I’m saying this because IMO there is a good chance that they learn the procedure and become your direct competitor!

My other question is if I ship directly from China to FBA USA and I hire a customs agent, do I still need to have an EIN number, or any other numbers that my company has to obtain prior to importing to USA.

Thank you.

I don’t think having your Supplier ship directly to FBA will motivate them to do it. Most Suppliers are aware of FBA and they’ve probably made a conscious decision to go that route or not, with or without your business. With that being said, your bigger obstacle is shipping directly to FBA. While it’s possible it’s fairly tricky and, in my experience, most importers still have their products shipped to a warehouse in the U.S. (even if the majority of the prep work is done in China) and then have it disbursed to FBA

Valuable post and it indeed helped us in getting clarity on sending shipments to USA. We are planning to send Bulk shipments from UAE to Amazon, USA (Pennsylvania) and would like to understand more on Importer of Records, We do not have a company registered in USA and neither do we have a physical address in USA. How can we go about it. We do have an agent to do the clearance and absorb duties and taxes too but they do not want to show themselves as IOR as they are mere service providers.

Looking forward,

Mathew

Hi Mathew,

Easiest thing is to simply have your customs broker be the importer of record. See the interview with a customs broker here: http://www.chineseimporting.com/customs-broker-interview/ (this exact question is actually addressed there)

Hi, I have seen contradictory info as to whether a foreign seller is required to pay US taxes. It seems the IRS believes that any sale on Amazon occurs in the US, title transfer of the goods is in the US, and income taxes are required to be paid to the US. I believe they are ineffectual at actually enforcing this but I would be cautious of the idea that “therefore, you should not have to pay any Federal Income Tax. ” I think (not sure here) that that may be incorrect.

I hate speaking of taxes (and the use of “should” and not “will” was used very deliberately) but I can say quite confidently, for Canadians, you *should* not have to pay any federal income tax if for no other reason than you can claim tax treaty protection. You do, as mentioned, have an obligation to report income, hence form 1120-F, and you are responsible for sales tax and potential state income tax. Normally I’m pretty cautious about any advice I receive from accountants, but this is consistent advice I’ve received from several accountants. Although, with that being said, any time we’re discussing Amazon things get muddy.

I agree with your post. There is no obligation for paying Federal taxes (if your country has an agreement. But you have to pay State sales taxes because there is a Nexus. Amazon does not own your product. You are the seller. See this article. Hope Im right. http://www.salestaxsupport.com/blogs/industry/us-sales-tax-for-foreign-sellers/amazon-fba-international-tax/

Glad I have some agreement :) And yes sales tax is the 100 pound gorilla in the room!

Hi David.

Thanks for creating such information.

I was wondering if I am a non-resident of the US and want to import goods under $2500 with a carrier via air, do I need to have a business identity(in my home country) for clearing customs or I can just clear the goods in personal name as the IOR?

I appreciate what you are doing!

Thanks

Hi Mark,

Speak to your customs broker to be sure, but you should be able to clear it under your name. But then, if you have a customs broker, they’ll be happy to be the IOR :)

Hi, David, very useful information, thank you!

I heard as a non-American importer you need to pay 500 USD bond annually to US Government.

“You can have it in bond in Canada so you don’t have to pay any duties or taxes if it’s in transit to another location”, What is the procedures or specific forms/documents to have imported goods in bond in Canada?

Hi Denny, See my other response, but no, you have your choice of a one-time $75 bond fee or a one-year continuous $500 fee (unlimited shipments).

Hi, David, very useful information, thank you!

“You can have it in bond in Canada so you don’t have to pay any duties or taxes if it’s in transit to another location”, what procedures, forms or documents are required in order to have it bond in Canada before shipping to US Amazon FBA? What about say you imported 2000 items and shipped 200 each time to US Amazon FBA? Or you shipped 200 items to Canada FBA, and the rest shipped to US FBA, Can you still have your US-bond goods in bond in Canada?

I heard as a non-American importer there is a bond ($500 per year) payable to US Government. Are you aware of this?

Thanks!

Your customs broker/freight forwarder will arrange it. It doesn’t take any more paperwork on your end (no idea what it takes from the customs brokers end). Without having your own bonded warehouse, you need to move everything in bond. You can pay $75 each time for the bond or $500 for a whole year. In other words, if you do more than 6 or 7 shipments, the continuous bond is cheaper. Again your customs broker will organize it.

Hi David,

Could you please share how you transfer your money from the BMO Harris to your Canadian bank account?

Thank you ~

I write a cheque :) Unfortunately right now BMO Harris only allows BMO -> BMO Harris online transfers and not the other way around (something I was shocked to find out after the fact). You can wire transfer it instantly, but you’ll pay a transfer fee.

Writing a check is actually a legitimate way. Do you have a Canadian business US dollar account for that? Also, do you convert some money to CAD in order to pay for Canadian accounting, taxes etc. ? If yes, I assume that there must be transfers of converted funds to the CAD business account…uff, my head is spinning…

Thanks a lot ~~

Yes, I have a USD account in Canada. And yes, I convert the USD to CAD on nearly a daily basis. However, as we all know, all Chinese Suppliers are paid in USD, so it doesn’t make sense to convert USD to CAD and then back to USD and lose a minimum of 5-6% in the process.

Yes, the conversion to CAD is still needed to pay for Canadian corporate operations, taxes, and some salary (if any :)).

David, regarding Canadian corporate taxes : would you suggest to hire a cross-border business accountant or any good accountant can handle it here in Canada?

Thanks a lot !!!

Hi Lidia,

I hate to give any accounting advice, but for our Canadian taxes, our CA has no cross-border specialty per se, although it can’t hurt (and you’ll probably pay for it)

Hi David,

Like yourself I would like to incorporate in Canada and sell my products to the US market.

However, in addition to importing from China, I also want to add a line of private label products that will be manufactured IN the US. Does the fact that I will have US manufactured products, mean that I would need to incorporate in the US?

Thanks

Hi Jon,

That’s totally outside of my expertise. I wouldn’t think it would but I really have no idea :-(

Hi David,

No problem, thanks for replying.

One other question: When you opened your BMO Harriss account – was it opened as a Personal, Small Business, or Commercial account?

Thanks!

Hi – just a personal account.

Be very careful as a Canadian about entering the US to sell US-made goods. My son almost got banned for a year from entering the US for this. Apparently US immigration has no problem with non-Americans entering the US to sell non-American goods, but thinks that selling US-made goods is a job for Americans, not foreigners. The best source of advice on this seems to be US immigration themselves, they are quite helpful but it would be advisable to clarify it before making the trip.

Interesting – I know any time you’re selling goods in the U.S. you’re walking a very fine line. Generally taking POs is fine, but taking payment is not. I wasn’t aware country of origin made a difference – it’s something I would need to look into to understand the nuances better. Thankfully, not much of an issue for someone importing from China :)

Hi David. So we have a construction company. We are dealers of steel buildings. Our steel buildings are manufactured in the USA. We have customers in the USA that want a building. I know we can sell them the building and use a company like AFEX to handle the money like a bank. My question is, do you know what we need to do, or if we even can, be hired by the customer to also put the building up? We would also hire local help there. Just do not know the ins and outs of going about this. Thank you!

Hi Janine,

This is a really specific question and way beyond the scope of the expertise of this blog. With that being said, I know from experience with family and friends, that both the United States and Canada allow foreigners to work for service work without a visa. I’m not sure if installation would fall into this category although my feeling is it probably wouldn’t. There’s a lot of immigration consultants and lawyers (not to mention U.S. Customs) who can answer this question fairly effortlessly and cheaply.

Hi David,

I am hoping to import from China and was thinking to send it to the US first (as the company mentioned that would be easier). Then I would be driving to pick it up and bring it back into Canada (Vancouver) where I would then sell the item (via my Etsy shop) back into US. The package will be courier and under $2500. Do I need to formally get an importers number and all the other paperwork involved? Do I get a broker? I am getting super confused as I read all the steps to import from China on other sites.

Thank you!!

I believe under $2500 it won’t need to be formally cleared into the U.S., assuming you’re shipping to a local mailbox in the U.S.. You’ll still pay duties of course though. I could be wrong, but that’s my understanding.

Why did the company mention it’s easier to send it directly to the U.S. rather than Canada? You’re going to get nailed for duties going to the U.S. and then nailed for Canadian duties once you bring the items back to Canada.

Maybe I don’t belong in this category because I have an American citizenship. However, I have not lived in the U.S. for over 22 years and have no intention of going back.

That being said, I want to sell, I don’t know yet what, in the U.S.

My question is, do you know if I need to create a legal entity (LLC?) in the U.S?

Another question. Do yo know if BMO Harris will open a bank account for a dual Swiss-US citizen living in Switzerland?

Thanks

Hi,

You shouldn’t need an LLC. I’m not sure about BMO harris, but i can’t see any reason why not.

Hello, you said: “There’s two small caveats to be aware of no matter how you’re shipping your goods. This concerns two fields on a customs declaration field called the Importer of Record and the Ultimate Consignee. ”

Do I have to worry about all of this if my Chinese supplier will ship the goods (using a carrier like DHL) to a Prep and Ship in the U.S ( who will then ship the items to Amazon).

The total value of each shipment will be less than 2500$ (if that makes a difference).

Hi,

If required, your prep and ship probably won’t have a problem being the ultimate consignee and importer of record. You can double check with them though.

Hi David i really appreciate the help you provide. One question that i want to ask is: if i buy with FOB terms will the supplier arrange the shipping process for me or do i have to arrange it myself. Another question is that,as i dont want my supplier learn that i am gonna sell on amazon FBA for “small company” thinking issues (from supplier), is there a way/service were i can sent my product to (as ultimate consignee) and they after arrange for the domestic shipment on amazon warehouses? Thanks again for all your value informations provided.

Just ask the Supplier to ship CIF [your port] and bill you for the charges. They’ll be happy to.

Yes, there’s a ton of places in the U.S. that can prep your shipments for FBA. Just search for “Pick and Pack” or “FBA prep”.

Invaluable information to say the least thanks so much david.

I have a question for you ..you said Amazon FBA (Amazon in yhe states) will gladly give me their EIN number to use but this does come at a price right ? I believe it is $150.00AUSD everytime you need it please correct me if i am wrong.

I live in Toronto,i called the IRS and obtained my EIN number as an international applicant which was assigned to my canadian address can i just use my EIN number ?instead of paying to use Amazon FBA EIN everytime i import?

Thank you

Hi Francis – I had no idea about the fee Amazon charges- I can’t confirm or deny this. I’m not sure if this is the EIN you’ll use (we always use our 3PL’s) but any customs broker can confirm this or not.

What donyou mean your 3pls? Is this some form of importing number ?

Hi Francis,

It means 3rd party logistics.

Hi David! I appreciate your help, but would like to ask you a different question. I’m a Brazilian non-citizen studying in the US and want to import coffee from Brazil. Am I allowed to receive coffee shipments and sell them to coffee shops being a non-citizen? If not would it be better to ship directly to the coffee shop from our company in Brazil rather than going through me? Is there any permit I’d need to have if I want to sell these products in the US?

Hi Rafael,

There’s nothing to prevent you from selling the items to Americans. People do it all the time and you won’t be subject to any special taxation if all of you’re doing is shipping products to your vendors. Regulatory approval is a different question and you would want to check with a customs broker as I don’t know the nuances for coffee. If you’re shipping small quantities to vendors you can probably fly under the radar but it’s not a sustainable long term strategy.

I just wish to say from the outset, great job in assisting foreign sellers who sell in the US. I am trying to start an online drop shipping business from a US based company. My problem, though, is trying to open an online account with FedEx, UPS or DHL, a requirement of the US drop shippnig company. The Online form to fill out is geared to US residents only. My country is not divided up into States and Zip codes like the US is, and those two fields are required. hence the problem. It is also virtually impossible to contact FedEx UPS etc by email or chat. The automated customer service rep does not respond to ones exact needs so it too is useless. How do I proceed?

Caswall, it’s late in the game but you can sign up for third party services that ‘give’ you a US address. Any mail you receive there can be forwarded to you, or they can open it and scan and email it to you as well.

Any suggestions, yet, David?

Hello David,

Thank you very much for the great information in your post & in the comments…

I live in Los Angeles, I’m going to be bringing a pet nutritional supplement from the manufacture in Winnipeg, Manitoba Canada to Amazon US for FBA.

May I ask what you recommend as far as shipping to Amazon US for small, & medium shipments?

Thank you again!

btw I found you from a Google search.

All the best,

Jeremy.

Hi Jeremy – Sorry for the late reply.

It depends what you classify as small and medium. If it’s small, as in it fits in a box, UPS or any carrier that lets you ship DDP. If it’s a pallet or more, contact any freight forwarder. Unishippers is a good one.

Thank you, David…

Hi David! Thanks for your help! Could you be so kind as to advice more particular situation. I m Canadian corporation. I buy goods in EU and bring to the US… Amazon FBA/ My Invoice price let say $100? but then I sell at Amazon for $200. It looks like income in the US? Plz comment. BR, Alex

Hi Alex – as far as I know you have income in the u.s. but it should be protected under tax treaty depending on where you are.

sorry if I m not clear … I m about IRS and income reporting…. when I started my tax interview I was asked to certify “?The income to which this form relates is

(a) not effectively connected with the conduct of a trade or business in the AUnited States, ”

Should I issue an invoice for $200 myself for import to avoid questions?

Hi David…

As a Canadian company I am exporting goods>$2500 to my fulfillment warehouse in Texas and I am being told I need to list my company as the USPPI (US Principle Party of Interest) and to do so I need a Federal Tax ID Number. I am also being told I cannot list my fulfillment warehouse as the Consignee. Can you please comment on this?

I’m not sure what the USPPI is. I’ve never been asked for it. I’ve always used our 3PL’s federal tax ID number. I would push your customs broker a little harder on this – something doesn’t seem right.

I too am Canadian and take my goods to the US. I have used a shipping center over the line for 6 months now who do my fulfillment. Recently i was stopped at board by customs as they just dont seem to like how i am taking my goods and having it fullfiled. I clear the enteries myself but questions of who collects taxes and who collects fees have come up. Do you have any advice on how to clear this up with customs so i dont have problems when i do an entry. I currently just use a cbp form 7523 and all of my shipments are less then 2500 usd.

Hi Ken,

It’s a huge issue crossing the border and IMO you’re never going to get away from scrutiny. IMO the scrutiny likely isn’t from your clearing customs for your own goods (there’s a million people doing that) the scrutiny comes from a very grey area you’re in terms of doing business in the United States. Are you potentially working in the United States in a way that violates the terms of the business visa you’re technically entering on? Are you liable for any state sales tax? Are you liable for any federal or state income tax? etc etc.. The solution: Have a freight forwarder and/or customs broker do all of it :)

This question of crossing the border came up for me once when I had goods manufactured in Florida for delivery to a customer in California. I wanted to inspect the goods before shipment (they were worth many thousands). US immigration stopped me and wanted to know what tool I would use to inspect! They said a tape measure was okay, anyone can use a tape measure, but if I needed to use a micrometer I was working in the US without a work permit and depriving an American from work!

In my experience, how much hassle you get will often depend on the temperament of the officer questioning you. As you mentioned, describing your activities in such a way that the border officer will in no way feel as though you are endangering a U.S. job is the best approach. You don’t need to lie, but you also needn’t volunteer more information than is necessary.

Hi David, I’m so happy to have stumbled on your website. I have been doing tons of research on how to sell on amazon but the more information I get, the more confused and overwhelmed I am, especially when it comes to the logistics involved with shipping the product from China to the fulfilment centres.

I am still doing product research and buying samples from China. I’m about to place my first order but I’m still confused as to how the entire process works. I want to buy your ebook but was wondering if the cost is in Canadian or US dollars (I live in Canada). You also mentioned on the article on how to choose the right product that it shouldn’t be a product that would sell for less than $50(if I’m not mistaken). For someone like me starting out with just a little over $1000CND, is it even possible to start an amazon business shipping from China with all the costs involved?

Hi,

Yes, it is possible but it’s going to take a lot longer to grow your business. Ultimately $1000 is a very small budget to work with for any business. However, I would try to get some ‘small wins’ importing small products from China and selling them on various marketplaces (remember, you don’t need to use FBA to sell on Amazon so you can simply have the goods from China shipped to your home). Once you have these wins, I’d recommend saving a bit more, to $2000-$3000 :)

I lived in MN, US now. And I am an amazon third part seller but all of my items were shipped directly from China to the buyers in US by Fedex. I only work at home (a small town in Minnesota) with clicking on my personal computer from collecting the orders’ info from Amazon to making order in China online. I have no office, no representative, no storehouse in US. I am pretty confused whether I have a Nexus in US. And whether I need to collect the sales tax from my buyers on amazon? Most of my buyers are in California and New York. Thanks!

BTW: My annual orders this year is over 2000. And the total money will be received from amazon (including my cost and profit) is over $100,000 this year.

From a Canadian perspective, if you are shipping directly from China to end customers, you would have no nexus. I suspect the U.S. is the same. It’s the job of border officials to decide whether to collect any tax/duties. Again, I only have experience with this in Canada so don’t take my word as gospel.

Hi David,

Great article from someone who’s been doing this a while! Have you ever personally driven stuff across the border or know someone who has? I have to a meeting at my fulfilment center regardless and thought I might bring down a load of goods in my truck, but am not sure how to set up the duties on that.

Hi Jerry,

Never going to the U.S. but plenty of times going to Canada. Just declare it to the border guards. I believe if it is below $800 they may just let you bring it down duty free. Worst at worst they’ll make you fill out a bunch of paperwork- might take a while but someone will help you with it.

Hi David,

Thanks for the extensive detail of dealing with US business as a Canadian based company.

Couple questions if you don’t mind helping me with:

1) I’m based in Toronto Ontario with a warehouse in Dallas Texas selling wholesale shoes in the US. I do have some store owner asking me for my Tax ID…How would I deal with this?

2) How did you open BMO US account?

Thanks

1) Tell them you don’t have one :)

2) You want to open it at BMO Harris.

Hi David

Thanks so much for this article, very eye opening.

I was just wondering if you could shed some light on my situation and hopefully help point me in a right direction as I am quite worried about my situation and thank you for your time as I hope to not be too long in my message:

I signed up for Amazon FBA as an International Seller last year May. I am a South African living in China. I signed the famous W8BEN form, then was allowed to start sending goods to FBA and start selling in the US. I immediately started to send goods and start selling. I contacted Amazon Seller Support a few times to confirm that I don’t need to file for any form of tax and they kept reassuring me that I didn’t need to (I guess they thought i was just listing and drop shipping from China and not using FBA).

I am not registered as a business anywhere in the world and have been selling individually. I have a “business” partner who is an American Citizen and its his bank account that we have been using to get the disbursements from Amazon.

Over the course of the year we have sold over $200 000 in sales and just under $100 000 in estimated profit.

The other day we found out that actually we are liable for paying all sorts of tax.

So my question was, what is the best course of action here do you think? Should my business partner and I register a business in the US, open a US bank account, file for EIN and then pay all the outstanding Tax?

OR

Is there a easier way to handle dealing with all this?

Thanks so much for your time

Kind Regards

Richard D

Hi,

I’m not an accountant, but a couple of things: 1) where are you paying income tax on the $100k of profit? If you’re not paying any income tax, then you’re evading tax somewhere :) If you are paying it, the chances are good that that country has a tax treaty with the U.S. and you’re not required to PAY U.S. income tax (but you are required to claim the treaty benefits). In terms of sales tax, you have a lot of obligations in various states to file u.s. sales tax. With that being said, the VASTTTTT majority of FBA sellers (u.s. or international) never pay this. You be the judge if you want to file or not.

Hello David,

I have a question. I am from Bangladesh and I want to export product to USA from China. I want to use PCB as you suggested before, but the problem is I can’t find their rates. Can you help?

Thanks

Kawsar

Hi Kawsar,

They’ll have to answer that themselves, but brokerage normally costs about $200-$300 per shipment plus duties.

Hi David,

Wonderful article, thanks for writing it!

I’m wondering if you have had any experience dealing with DHL or FedEx or UPS as a complete supply chain solution?

I am based in Australia and I am looking to import goods straight from my manufacturer in China to the US. The goods will already be pre-sold, so as soon as they arrive to the US, they will be sent straight out to customers, without being put into storage. There will be quite a few items, a 40ft container load. Have you dealt with any of the aforementioned delivery services whereby they assist you from the time the goods arrive in the US, including customs clearance, unpacking from the container, processing the individual items, and then distributing around the US to the individual consumers who have pre-purchased the items?

Because the items will be sent straight to the customer, it seems that using a designated 3PL warehouse is a waste of money.

Your thoughts are highly appreciated.

Regards,

Jordan

Hi Jordan,

If you need someone to basically help you get a container of goods from China to your customer in the U.S. a freight forwarder is going to be your better solution than UPS/FedEx/etc. simply for the fact they’ll be able to offer more bespoke service to you (good looking having one rep be your point of contact for you with UPS).

Keep in mind, no matter who you’re using, most likely you are basically going to be using a 3PL (whether that 3PL is owned by the freight forwarder or not) and you’re going to be charged appropriately so. However, what you’re trying to do is very common (especially with FBA sellers nowadays) however, normally people use a freight forwarder to get the goods to the 3PL and then have the 3PL handle all of the shipping on to your customers (cross-docking).

Hi David,

I was hoping you could help me with any information you might have or to assist with pointing me in the right direction to find it. I’m actually trying to research this for a friend of mine who currently runs a business in Canada and would like to bring a team from Canada to sell his products in the US at certain events. How would he go about doing this? Does he need to obtain a work permit for himself and each member of his team? I tried to look into this but I couldn’t find one that applied to his situation as an entrepreneur. In which case, would he need to incorporate his company in the USA in order to be able to sell his products in the USA?

I’ve spent countless hours trying to obtain more information so any help would be most appreciated.

Thank you.

Hi Michelle,

Unfortunately there’s no easy way for a canadian to sell products at a u.s. trade show. You can accept purchase orders at a show (and then process the payment back in Canada) but not sell products for immediate payment.

Thank you for getting back to me on this. I appreciate your input. By the way the title of your post “NI HAO DONALD TRUMP – THE IMPACT OF TRUMP’S ELECTION ON IMPORTERS FROM CHINA” totally cracked me up! I barely speak or understand Chinese myself (even though I am Chinese, I think you are probably more Chinese than me) but I did understand “NI HAO” and thought it was hilarious!!!

Thanks again!

Hi David,

Thanks for the valuable information.

I am from Winnipeg Canada, i found very little information about i can i start an amazon fba business in US from Canada. But your article is very informative and valuable.

I would like to know if i start my Amazon FBA business from amazon.ca, do i need an import license to get my products in Canadian Fba warehouse from China?

Thanks

If you have a Canadian business, your business number is the same number you use to import. You can technically import your goods personally without ever getting a business number but as you’re importing them for commercial reasons, you officially need a business number. Regardless, you should get a business number as it costs next to nothing to get and you will need it at some point in your business career :)

am just wondering if President Trump of the United States does what he stated in his campaign…adding a 45 percent tax or tariff on imported goods that it would make importing from china to the united states futile and other distribution points like Canada would be an option..the question i guess really is if american consumers would continue to purchase chinese imports regardless of the distribution point and how that is all tracked to levy the tax.

If you mean importing from China into Canada and then redistributing to USA, it wouldn’t make a difference. The goods are still considered made in China (and NAFTA DOES NOT apply). With that being said, it’d be very difficult for Trump to single out China due to the WTO (he could pretty easily impose across the board increases though to all countries).

Hi David, this is great and concise info, thanks! I’m looking to dropship from China and was trying to find any info if as a non US citizen/resident I needed to open an LLC in the US (WY or DE), but I saw some info that led me to believe I didn’t have, and your article seems to confirm it. The IRS allows for foreign entities to apply for an EIN for banking purposes. Is this the route you went? Also, did you have a mailing address in the US (even if it’s a mail forwarding service) to use as your US-domestic address when signing up for Amazon, Paypal, banks, etc?

You can sign up for personal bank accounts in the U.S. no problem without an EIN. I’d have to have someone confirm but I believe you may even be able to get a corporate account, but I could be wrong. Either way, Paypal and Amazon can both withdraw to a Canadian bank account although they have to convert your US dollars to local currency.

Im actually a Canadian selling products in the US for the past few years as well, great article you have here, I wish I would have saw this blog when I first started out years ago haha.

Im now starting to get approved for wholesale accounts from big brands and one of the things that some of them ask is a resale certificate, whats this certificate do and can you easily get one in the US as a Canadian company?

Thanks!

resale certificate in most cases is basically to make the sale sales tax exempt. If you’re shipping from Canada you can just say you don’t have one. If shipping from the U.S. you would need to register for a tax ID in the state your goods are stored – if you don’t want to do that try just telling them you don’t have one.

Hi David,

Does the below make sense to you in terms of importing from China to the USA as a Canadian as a possible option:

I’m Canadian. Going to ship product from China to US (California) directly to my fulfillment company (not FBA). The fulfillment company will pick the product from the master carton and ship to the customer. I will be incorporating federally in Canada and then setting up a foreign c corp entity in the state I create nexus in (California). I want to avoid the hassles and do it right by setting up an EIN number since it appears to be easier to have one in the long run. I will be setting up a virtual mail address locally in Canada to be used as my corporations address. I will also be using a registered agent service as it is a requirement in California for all legal docs and state notifications. I will consult with an accountant but I know that I will be entitled to a foreign tax credit from CRA against the corporate taxes paid in California. Also learned that if setting up as an LLC (which I’m not) as pass through, CRA will still treat it as a separate entity and therefore you will not be entitled to the same dividend treatment as Canadian Dividends when divends is paid out. I will be collecting sales tax from California customers only and remitting to the state. I will also be shipping a smaller portion of product from china to my home in Canada so I can have stock ready for Cdn customers which I will manually ship in the beginning.

I will also be using a customs broker and freight forwarder or courier depending on final weight of shipment which is TBD. I will setup a US Bank business account and have all money deposited in there from sales of the product. All US expenses will be paid by that account as well. All cdn expenses will come out of my Canadian corp business account such as accounting fees, or CDN customers. If I need to transfer money from us bank account to Canadian account I will write a cheque or wire money or transfer to a US dollar account if it’s the same institution. I.e. TD.

If I need to use fba in the future then I will need to consider shipping to a 3pl in California preferably and then to Fba.

This is the approach I am thinking of pursuing. Does it make sense? I plan on having my non fba for product that is sold from my site and fba for all Amazon purchased product. I could in theory have the product shipped to a Canadian address first in bond and then prepped for Amazon, take some product off the pallet and then send the rest to fba and my fulfillment but it sounds so much more complicated that way.

Trying to find the simplest method.

Hi,

Way too much detail for me to analyze in a comments section but you’ve clearly given it way more thought than 99% of other people which is either good or bad. Make sure you don’t get stuck in paralysis by analysis and make sure you’re spending the VAST majority of your time on selling products and not all the legal and accounting mumbo jumbo which creates 0 revenue for you.

Hi David,

Great article and on a side note fantastic book (Importing from China is Easy), read it on Amazon kindle, that’s how I found your website.

I had a question regarding paying for customs duty via air express (DHL, UPS etc). It’s something that’s worried and confused me for a while. I live in the UK and plan to ship goods from a manufacturer in China to Amazon fba warehouse in the US. If I understand correctly the Importer of record responsible for duties cannot be Amazon and will need to be me (my name and UK address on the form).

Now when I pay the Chinese supplier the agreed price for the manufactured products and the shipping fee quoted, am I right in saying customs duty will need to be paid once the consignment physically reaches the US and not before (i.e in the air)?

And If so how do I, in the UK, pay/be billed? Am I paying the courier or customs directly? As the only information they have is name and address, will they send me a letter? (which would mean I would incur holding fees?). Would they give me a phone call? (although I could not see an option for telephone in the IOR section in your image). I’m about to pump a large portion of my savings into this, so I’m nervous of my goods being rejected, thus incurring costs I cannot afford?

Thanks and sorry for all the questions.

Osman

Hi Osman,

You need to make sure the goods are delivered DDP (delivered duty paid) which you can request with DHL/UPS/etc. essentially meaning they’ll bill you and not the addressee (aka Amazon). Make sure your Supplier truly understands what you mean when you say DDP, other wise call DHL and setup an account and they’ll walk you through how to do a DDP shipment.

Hi David, thanks for the reply.

I spoke to DHL (UK) this morning. They called me after I registered an interest in setting up an express account. I spoke to their Small Business Export Advisor and told them I’d be shipping private label products from China to the US for the Amazon.com marketplace. I explained the shipping terms would have to be DDP and I would be the IOR (Importer of record) as Amazon cannot be the IOR and rejects shipments if duties & taxes haven’t been paid. I asked them how I would go about paying customs duty since I’m in the UK and the shipment is being sent door-to-door (China to the US).

They told me this is called 3rd country shipping, which they don’t do. And because you can only open an account in the country you’re based in, I couldn’t open an account with DHL (US) as I wasn’t a resident. I was told the only work around would have to be sending the shipment to the UK from China, then onto the US. I’m so confused since I’m obviously not the first non-US resident to be selling into the amazon.com marketplace.

Thanks.

Osman

Hi Osman,

Thank you for the detailed response! I must confess, our company has a Canadian and us ups account (we’re registered in both countries) and I wasn’t aware of the issues in shipping to a third country like you mentioned. I guess in that case you would need to have your supplier arrange shipping or use a third party freight broker. The other option would be air freight and formally clear customs into the us yourself through a customs broker, but this would cost more for smaller shipments.

Hi David,

First and foremost, thank you for the great article. I found it very informative and put me at ease as I am looking to get into selling through Amazon FBA and I live in Toronto.

From what I’ve read above, it’s clear that on the US end, all I’ve got to worry about is sales tax in the states where my product will be stored (if that). My question is, now when filing income tax on the Canadian side what are the types of things I should keep an eye on? Are profits made in selling products in US on Amazon considered capital gains for my Canadian income tax? I’d appreciate your insight on this.

Thank you in advance,

Marcin

Hi marcin,

If you’re based in Canada then your profits/losses in America are part of your company profits in Canada.

Hi David,

I have an EIN linked to a sole proprietor business outside the US. I want to ship goods from China to my US address (NOT AMAZON FBA).

Can I use my EIN for this? (Ultimate Consignee)

How will this affect my tax obligations?

Will this be seen as working and receiving income in the US by IRS?

I’m not sure but most 3pl’s are happy to give you their tax id and be the ultimate consignee (in fact I believe Amazon will be this as well). I’m not 100% certain but I do not believe this will have any impact on your notes states income tax liabilities.

Just read that the state of Virginia does not consider consider the practice of storing product in warehouses as creating ‘nexus’. If this is true, I presume no sales tax requirements. Can anyone confirm this?

Hi Mike,

Can you share where you read this?

Hi David, I’m a Canadian that recently incorporated a company federally in Canada for the purpose of starting an Amazon.com FBA business. Does your ebooks address how to set up an Amazon FBA business for a Canadian corporation? Ideally I’m trying to do everything through the corporation but I’m hitting two bumps in the road: i) to set up an Amazon Seller’s account requires a credit card which my newly created company doesn’t have so is it okay to use personal credit card or should I investigate how to open a business credit card?; ii) I too didn’t like the exchange fees incurred on switching back and forth between USD and CAD so I’m following your guidance and I’m working on opening up an account with BMO Harris. Correct me if I am mistaken but it sounds like you opened a personal checking account from BMO Harris, so is it advisable to use a personal checking account from BMO Harris for my Amazon Sellers Account? I’m trying to request a business checking account for my Canadian Corporation but the bank is asking for an EIN. I apologize for throwing a lot out there and I deeply thank you for the valuable information you’re provided on this website to help entrepreneurs import products from China.

Tai

The ebook doesn’t go into detail about this. With that being said, don’t get hung up on opening business bank accounts/credit cards/etc. until you have some real revenue being generated. Use your personal accounts. Especially on the U.S. side of things, it’s very difficult to get U.S. business bank accounts/credit cards, especially until you have an EIN.

Hi David,

Thank you for the great article, I was able to find lots of info I was looking for.

I have been selling on Amazon FBA Canada for a year now and would like to expand to .COM

I am still trying to complete the puzzle and still confused with regards to the EIN account and sale tax.

When exactly an EIN account would be needed? Would I need one if I will use DHL/UPS to ship DDP to Amazon FBA small boxes (10Kg and 100 items)?What exactly determines the value of the shipment? IS it the inbound shipping oder created on Amazon or the supplier invoice when I receive it in Canada?

With regards to sale tax, will Amazon add the sale tax automatically for the items sold in those states? I am still under 30k anual sales and not charging sale tax in Canada. How do you file the sale tax in USA?

EIN you should not need – you’re a non-resident importer. The supplier invoice determines invoice value. Amazon can charge sales tax but it will not remit it- that’s up to you. That involves reporting to each state authority (like you would for PST or GST for example) and way too big of a topic to answer here.

I accidentally found your blog as I have been frantically trying to find some solution to my slightly unique problem. I apologize in advance for being so detailed. I could not make it short as I must explain the situation in detail to get the full view of my confusion.

Background:

I am a US citizen from Seattle. I have been in India for some time researching on sustainable products that I could sell in the US market. I am now designing and developing samples for organic cotton infant clothing line.

As I have a resident status here in India, my initial plan was to design and manufacture in India and export to my buyers in the US. I would take samples every season to the US, get orders, return to India, have them manufactured and ship to the buyer. I registered as a sole proprietor company India with this plan in mind.

Being brand new, I know that I won’t get huge bulk order yet and later I found out that no Us compliant and certified manufacturer was interested in smaller MOQs. Also, they refuse to sell it to any domestic company like mine due to export drawback subsidy incentive given to exporters by Indian govt. So I have now decided to make a larger sample order at the sampling rate and have them export to the US. I could just sell them over the counter with minimum margins to the boutiques and stores so they can try a smaller order. This will get me an initial foot in the door orders.

Question:

Here’s my question and confusion: If my factory wants to be the exporter from India, how can I be an importer in the US without registering a company in the US? As a Us citizen can i import it without a business tax

identification number? I can be present in the US when my shipment arrives so will be able to receive my goods and not send it to warehouse or fulfillment center? I can have it stored in my cousin’s garage for a short period of my stay in the US – as it will be a limited stock quantity (about 3000 pieces of tiny infant clothing).

Lastly, can I sell to the boutiques over the counter with the invoice from my Indian company? Will there be a sales tax? I don’t want to register another company in the US just yet. It will cause double tax for me and delay in setting up while I am in India. I could miss the season. If I can work around it and still be able to import and sell in the US as an Indian company, that would be great.

As per this blog, foreign importers in the US are able to send the goods to fulfillment centers. My story is slightly different as I am a US citizen with a registered foreign company and I want my products to be imported in the US and be send to me so I can sell them under the invoice of my Indian company. How does all this work? Please advise.

Thank you so much.

Hi Reshma,

Far too many questions unfortunately to answer in one go and way beyond the expertise of this blog. Yes you can import as a non-resident importer – you get whats referred to as a Customs Assigned Number. Your Indian corporation is an entirely different entity than you so whether you’re American or Martian should be irrelevant. Don’t quote me. I’d speak to http://www.pcbusa.com and they can help you with all the nuances. The tax questions are getting way beyond the focus of this blog – you’ll need to speak to an accountant, mossadams.com specializes in this type of thing. Expect to pay about $400/hour though.

Thanks a bunch Dave. Apologies to have many questions there. Appreciate your reply despite the long read

Hi David,

Such a blessing that I get accross your article! I want to ask, Amazon is requiring sellers now to have an EIN and sign the W8BEN if you are a foreign seller who wish to sign up with them. From what I read, W8BEN means that you are claiming excemptions or deductions if treaty is existing for your country. I am from Philippines and lives as an expat in Singapore. I am planning to dropship items from China to USA FBA. The thing is, Philippines has a treaty with USA and I can claim tax deduction of 15% (which is a relief). In addition, I also don’t have to pay PH tax because my income is not sourced from PH. Where should I file the other 15% due for US? Will amazon be witholding it for me (directly deduct from my gross profit) thus I need to submit another form to them? Or do I even have to pay income tax at all? I want to set things right from the beginning to ensure to troubles in the future. I know that the best course of action is to seek advice from an accountant. But I am just an individual (not a business yet) trying to get into this thing.

Thanks in advance for the help!

I could be wrong, but I believe Amazon requires an EIN OR to sign the W8BEN (not both). I have no idea about the Philippines tax/treaty law, but you need to pay tax to someone. This is why tax treaties exist. If the Philippines is like Canada you would normally pay tax in the Philippines. Although you’re not selling the products in the Philippines, all of your work (which is the main cause of your profit) is based in the Philippines.

Awesome post! I’m actually going through this process right now, I’ve been reading for hours upon hours on this subject. I’ve hit a large roadblock right now. I’m Canadian and I’m looking to import from Hong Kong to the US, and in to a fulfillment center. I requested the fulfillment centers US Tax ID but they will not issue it for use on my import. I contacted 4 other fulfillment centers, and none of them will allow me to use their Tax ID also. I’m not looking to create a US corporation, as I already have one in Canada. Any suggestions? Thanks!

Hi Dan,

That is bizarre – I’ve never had a problem with any 3PL providing this. Even Amazon will provide theirs. I suspect there’s some miscommunication happening. Make sure you mention you want them to be the ultimate consignee, not the importer of record.

Hi Dave,

Thank you for writing up this article, it definitely touches on some concerns I have. I’m also in Vancouver, I have had a e-commerce business in Canada for about 2 years now. I recently started shipping my products to a US warehouse (not FBA) to expand my reach. I’ve been importing a bunch of goods into Canada and then repackage them in smaller shipments and ship them to US from Vancouver. What I want to do next is shipping directly from my Chinese suppliers to the US. Most shipments go by either DHL or UPS air. If I read your article right, it doesn’t matter where I ship from, if it’s under $800 or $2500, I should be able to clear customs without an EIN, is that correct? Currently I’m using the supplier’s DHL and UPS account, should I be using my own DHL and UPS account in case I get hit with duties and taxes? I currently use their brokerage service to import to Canada. Can I use the same one to import to the US?

Thank you in advance !

You don’t need an EIN regardless – there’s non-resident import numbers you can get either on your own or through a customs broker like PCB.ca. But yes, the $800 number is important to avoid duties and needing formal clearance into the U.S. (that $800 ‘de minimis’ number is only $20 in Canada). If your Supplier trusts you they can ship “ddp” and simply have all the taxes/duties billed to them and then they’ll charge you for them but if the goods are under $800 this doesn’t matter.

Hi There!

Great article, thank you for that. I am a US citizen and would like to sell goods from India (I visit there a lot and have some supplies for clothing that I want to import into the US and sell there here). Can you let me know if the process is simliar and what would the differences be?

Can’t speak from experience, but there shouldn’t be any differences.

Hi David,

Thanks for putting out quality information on a rarely touched topic.

As we approach 2018, is PCB still your recommended freight forwarder/customs broker? Any opinions/experience with a company called Flexport or any other freight forwarders?

Also, did you complete a power of attorney form for your broker to act on your behalf? Should one be mindful of anything when completing a POA form for this purpose?

Do you use your Amazon seller (display) name or your company legal name for shipping paperwork (IOR, BOL, POA)?

Thank you.

Yes PCB is still very good. I’ve heard good things about Flexport but never used them myself. POA is pretty standard – I’m not aware of any issues. As far as I know, BOL and POA have to be your company name not Amazon seller name.

Flexport is very good (you need to attend their webinar to get your account setup) — have used them several times and the customer service is great also. Prior to going with Flexport, I heard good things about PCB so I emailed PCB several times with general inquiries to test how quickly they would respond; unfortunately, I never received any response from them on numerous attempts for simple, straightforward questions.

Thanks Victor – that’s disappointing to hear about PCB and thanks for the review about Flexport! PCB has always been very responsive to me but perhaps you got the wrong person. I’ll keep my eyes/ears open for any other similar comments in the future to see if you were the exception or the rule for new customer service.

Hi Dave,

Very good article. What If you don’t need a warehouse in the US, and simply just want to sell and ship your products directly to US consumers from the country your business is based?

Do you still need to worry about sales tax then? Or is imports/customs only the “barrier”?

Best,

Johan

I don’t know what each individuals state tax rules are (they could be different) but I know often it’s the individual’s responsibility to self report in these cases (which of course no one does lol).

Dave,

Amazon says they may be listed as the Ultimate Consignee but only if the if the name of the Amazon entity is followed by “in care of FBA” on the shipping documentation.

Do you know what shipping docs they’re referring to and do you do this yourself?

Thank you.

This is normally your customs import documentation that will be done by your customs broker.

Thank you so much for providing such detailed information!

Even worth more than the ebook I’ve bought!

Thank you :)

Thank you so much for this information. It clarifies so many doubts. Just to be clear, I would like to ask you a few questions, for which ill give you background. I´m a young entrepreneur looking to build an FBA business from Venezuela (Im aware of the fact that Im not on an approved country, but I do have a US address and bank account so its ok). Now my questions are, and thank you in advance:

1) Once I pay the manufacturer, do I need a freight forwarder to complete my customs duties and such or can I just pay FedEx or UPS to send them directly to the Amazon warehouse? (My orders will be less than 2.500$)

2) If I set up my seller account with a U.S address, but put my Venezuelan address on the Importer record, will that get me any legal trouble?

3) Should I pay a China to US freight forwarder to do the procedure? If so, which would you recommend?.

Once again, thank you so much for all the help!.

Best regards,

Marco.

Hi Marco,

Sorry for the late reply.

1. Yes, FedEx and UPS can normally handle it under $2500.

2. They’ll either reject or accept you Venezuelan address as the Import of Record when you submit customs. Having a customs broker (NOT UPS or FedEx) eliminates any issues here. Amazon though doesn’tcare.

3. A freight forwarder is one relationship you should develop early…they’re cheap and will save you a lot of trouble. Try PCBUSA.com (and let them know ecomcrew referred you :)

Hey Dave

I am a canadian Citizen and wanna import my books to USA from Iran.I arranged with tranportation company and broker in Sanfrancisco!But she told me you should put some one name here who has social security number and I

Thought to put my friend’s name who is American for delivering my books under his name!

Do you think this is fine ?! Or US will tax him for my books?

I opened a new RBC US account which I received my bisa debit and my credit card for US to use here!

Just plz let me know about putting my friend’s name for US Sanfrancisco airport costumes ?

Also after I sold my books,should I only declare that to Canada as my income ? Or USA ?!

As I might get my Green card here around end of 2019 fall ,but I am not sure yet!

Thanks for helping me

Pa

The importer of record (i.e. your friend in this case) will be liable for any unpaid duties. This is a sensitive area importing from Iran due to sanctions so I want to be careful what I tell you one way or the other.

The taxation issue is beyond what I can answer in this comment :)

For Canadians, RBC has a cross boarder account, I’m assuming that should work for this purpose too? But it does cost $40CAD / year.

https://www.rbcbank.com/cross-border/us-bank-accounts.html#new

Yes, it works, although they will force you to get a business account once your transaction volume gets too big.