How to Clear Customs When Importing Goods into the USA and Canada

One of the biggest challenges for importers is clearing customs for their products once they arrive in their home country. This guide will give a solid overview of how to clear customs into most countries, including Canada and the United States.

I am not a customs broker; however, I've imported hundreds of shipments over the years and can provide some down-to-earth advice.

There are a number of excellent guides produced by countries for importing commercial goods into their country. These include:

We also have an excellent guide on How to Import from China.

Related Podcast: Episode 260: Ecommerce Accounting Essentials for Online Sellers

What is Clearing Customs?

Clearing customs is two-pronged. It involves preparing the necessary paperwork to import your products and also paying any applicable duty/tariffs that need to be paid. Each country has an agency to facilitate this. In Canada, it is the Canada Border Services Agency (CBSA) and in the United States, it is U.S. Customs and Border Protection (CBP).

It's pretty straightforward for the most part. But some products may also require you to submit additional, required documentation (normally related to safety).

When your products arrive into your home country (for example, via a seaport) they will not be released to you until the appropriate paperwork is filled out, along with paying any necessary duties.

The import procedure should be fairly analogous for anyone who has ever travelled internationally. When you arrive back into your home country, you are asked to declare what goods you are bringing back with you. If you're past your exemption, you have to pay applicable duties and taxes. It's the same procedure when importing commercial goods, it's just that there is no exemption and the paperwork is slightly less user-friendly.

The De Minimis Level

Almost all countries have something called a de minimis level. This means that any imports below a certain dollar value are not required to have formal customs clearance and/or have duties/taxes paid.

In most countries, this level is under $100. However, in Canada, this level is now $150 and in the United States, it is a whopping $800.

What are HS Codes and How Do You Determine Them?

The single most important thing that all importers must know when importing is the 10-digit Harmonized Item Description Code, better known as an HS Code. Almost every time you import items you will need to know the HS code of your item.

As you can imagine, there are millions and millions of different products that exist in the world. How can a customs official be expected to know the details of every single reverse osmosis water filtration system and 2-in-1 Rice Maker/Slow Cooker in the world? Easy- the Harmonized System.

The Harmonized System is simply a big long encyclopedia of product descriptions covering every product imaginable. Almost every single country in the world uses this system.

Product classifications do not change (for the most part) from country to country. The only thing that countries change is how much duty they will charge. For example, we import a particular bag from China for off-road vehicles. In Canada, the duty rate is 10% but in the United States, it is 0%.

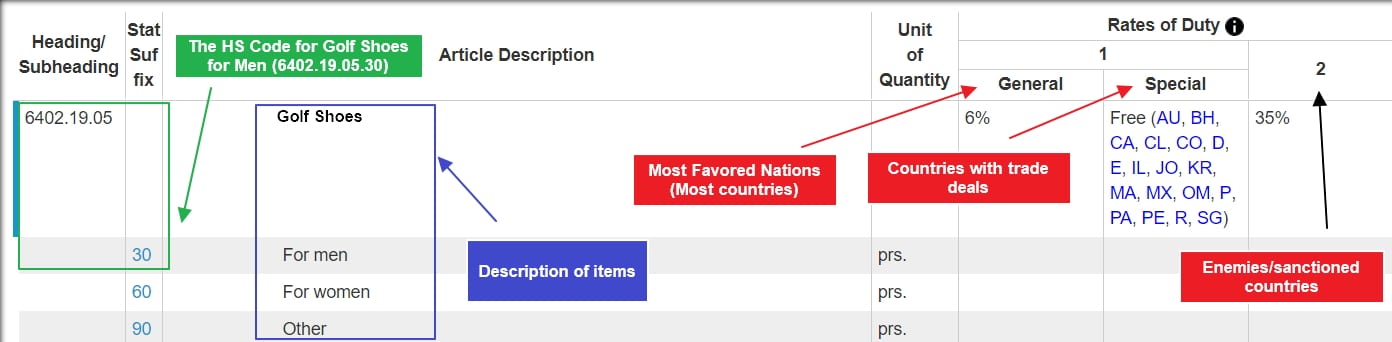

Below is an example of a classification for different types of golf shoes.

The HS Code breaks down as follows:

7316.11.10.90 << This is the complete HS Code

7316 << International Heading (shared by all countries)

11 << International Sub-Heading (shared by all countries)

10 << Tariff Item (Set by Individual Country)

90 << Special statistical tracking number (Set by Individual Country)

As you can see, countries share the first 6 digits of the classification code and then each country sets the remaining four codes. This means that you can use another country's classification and tools as a starting point for determining the exact classification code for your country, but you can't rely on another country's codes completely.

There's also something called Most Favored Nations which we'll get into below.

There are a number of good tools for determining your product classification code. The United States has a fairly handy Schedule B Search is also a good place to start. Simply give a couple of keywords to describe your item and you should be given a few results which you can further narrow down after (more words on this shortly).

Most countries have huge PDF documents listing all of the classification codes. Ultimately, you will likely want to go through a few pages to read what code best describes your product. It's actually somewhat readable as well as interesting.

So, to determine your classification code, you can either a) use a tool like Schedule B Search to find at least what section you should look in and then manually dig deeper, or b) simply use CTRL-F to search the PDF for some keywords. More likely than not, you will find a classification that describes your product very accurately.

What Happens If More Than One Code Describes Your Item?

Are you finding that more than one classification code describes your item? You're not alone!

I was once importing a particular item that could have a different classification code depending on whether it was used primarily for aircraft/watercraft or other purposes. Our customers used this item for both watercraft/aircraft and in their homes, almost evenly split. So which classification code should apply?

Often you have to make a judgement call. If in doubt, choosing the higher duty classification will save you any potential negative ramifications from underpaid duties.

Your other alternative is to seek out a professional customs broker classification. You can also request an official classification from the government customs agency. Both will normally cost you some nominal fee (although many customs brokers will classify items free of charge for current clients).

Remember that most countries' customs procedure is based on a ‘random audit' system just like your taxes. Deliberately misclassifying items will work most of the time, but when you do get caught the fines can be very punitive.

Customs Clearance Paperwork

When importing goods, almost all countries require, at a minimum, two pieces of paperwork:

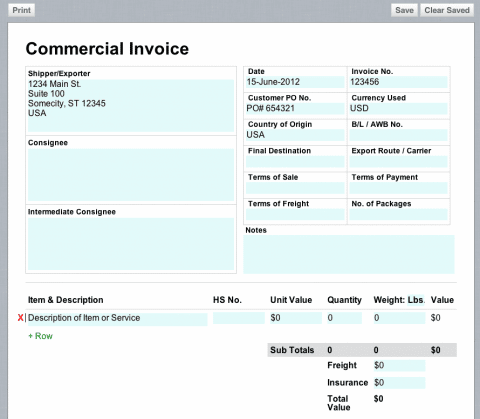

- A commercial invoice from your supplier

- Some official customs form

A commercial invoice is simply an invoice your supplier will give you itemizing each product you ordered and how much you paid for it.

This is nothing special and it can be a PDF, an Excel document, or handwritten on a napkin. If you're importing from China, your supplier should provide this invoice to you without you even asking.

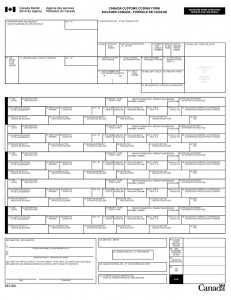

The official customs form is unique to all countries, and in some countries, it's more complex than others. Below is a Form B3 which is required for importing into Canada. In the United States, it is called a CBP Form 7501 “Entry Summary”.

These forms may look complicated but are actually only looking for a few basic pieces of information which we'll cover here shortly.

Other paperwork that might be required:

- Copies of appropriate memorandums, permits, certificates, etc.

- Packing Lists

- Cargo control document (or similar)

Certain products may have unique permits that are required. For example, many food and drugs require certification from appropriate national agencies (such as the FDA in the case of America). However, there's other more mundane forms, which may be simple ‘promises' that an item contains no wood products, that it was made 100% in a certain country, etc. Most products will not require any special documentation. Call your local commercial customs office and tell the official exactly what product you are importing (ideally with an HS code) and they will tell you what is required.

A packing list is simply a document showing how a shipment is boxed, i.e. 10 Pairs of Sandals in Box 2a.

A cargo control document is a unique term in Canada but other countries have similar documents. It's simply a document given by a freight forwarder that gives a container or shipment a unique ID that helps customs officials better track and locate the shipment.

Related reading: How to Get Your Products from China to Amazon FBA

Paying Duty and Taxes on Your Product

Your HS Code will determine the rate of duty on your product.

As mentioned, each country sets their own individual rate of duty on items. This varies widely according to product and country, but for reference's sake, for most of the products my company imports the rate is around 0-20%.

The second determination of how much duty you will pay is the country of origin for your product. Most countries fall under a somewhat misleading classification of Most Favored Nations (including China for most countries). These countries will all have the same duty rate applied.

Refer back to the HS classification for golf shoes. You'll see it has three columns for the three classifications a country can fall under.

The exception to Most Favored Nations are countries that have other trade agreements (such as NAFTA in North America) or enemies, such as North Korea (in these cases, duty rates are often 100% or more).

Depending on the taxation system in your country, you may also be responsible for paying applicable taxes on this. Also depending on the taxation system, you may or may not be able to get these taxes back. For example, in my home country, I must pay 5% GST on all goods that I bring into Canada. However, I can claim back all of this GST at year's end. In the United States, which has no federal tax, there is no tax payable.

Using Import Records to Find and Vet Suppliers and Snoop Competitors

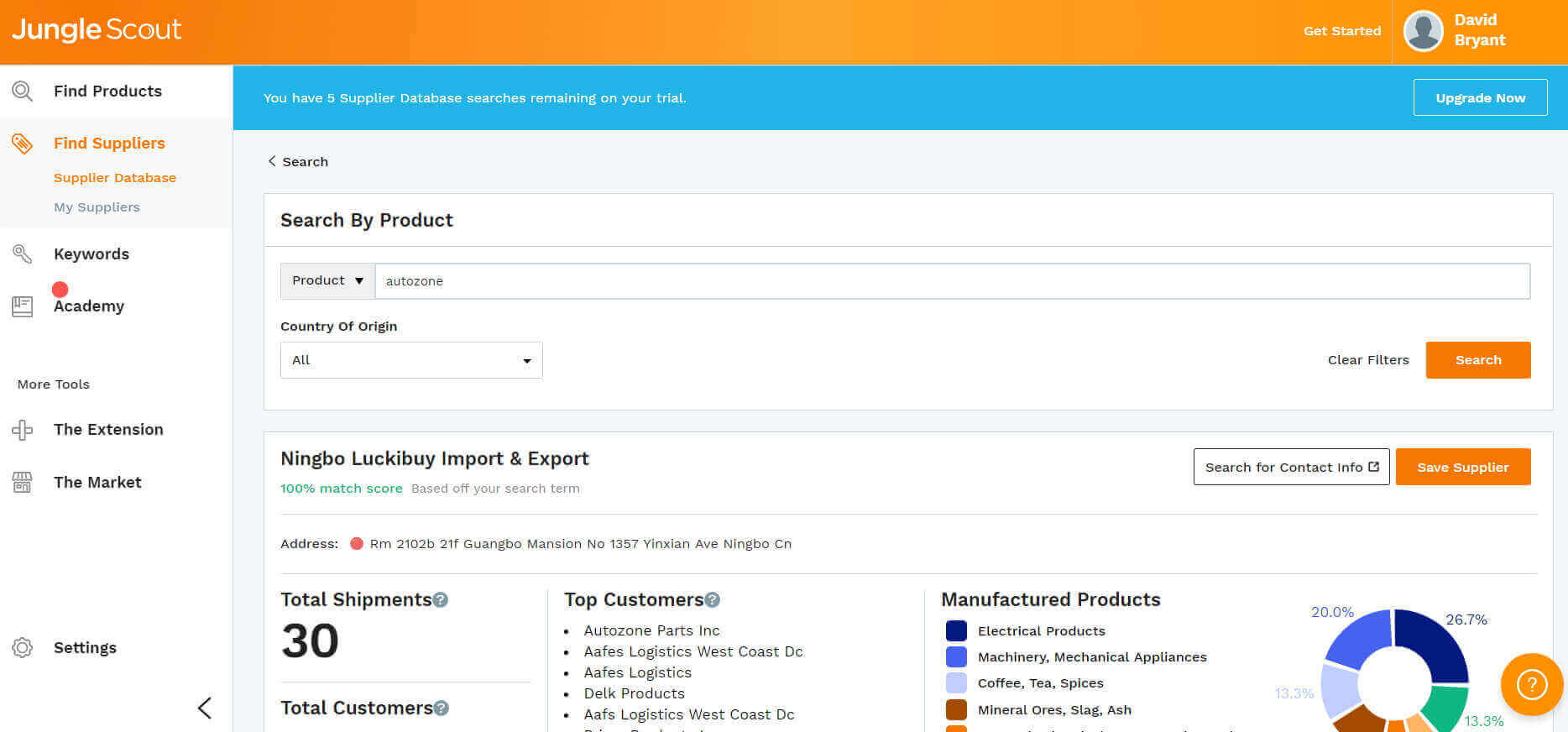

One of the best things an importer can do is to use import records to help them find products to import and vet suppliers.

As mentioned, in America, import and export records are public information, however, the government does not catalog or give easy access to this information. However, there are tools that do allow you to easily search this information, the most popular and cheapest being Jungle Scout (others include Import Genius and Panjiva).

These tools allow you to:

- Find out what Chinese supplier a competitor is using (great for finding products)

- See how much a supplier exports

- Find out what suppliers export specific products

See our article A Secret Weapon for Doing Supplier Research

Other Information Required on a Customs Form

Outside of the HS Code, most of the information required on a customs declaration form is rather straightforward. Things like your company name and address, date of import, the name of the supplier, etc. are all standard.

There's only a couple of other things to look out for.

First, remember that you will almost certainly be declaring your goods in your home currency. So even if you paid your supplier in USD you will be expected to convert the price of the products to whatever currency you use in your home country. Generally, you're expected to use the official exchange rate at that point in time (for example, the Bank of Canada official exchange rate).

You may also be required to record some type of business identification number, in the case of Canada a Business Number.

Presenting Your Paperwork and Finally Clearing Your Goods

Once you have filled out your paperwork, you will be required to present it to the customs officials.

If your goods are being shipped via land, normally you would simply do this at the land border crossing they are going through. If they are being shipped via sea, you can normally submit the document to any official customs office, normally located at a point of entry.

In my province of British Columbia, Canada there are over 200 points of entry, many of which aren't actual points of entry. Remember, international airports are points of entry. Simply Google “Customs office [your city/country]” and you should get a list from your government. For Canada and the USA these offices are:

Once customs officials approve your paperwork, you will have to pay them any outstanding duties. Most will not accept credit cards and many will only accept cash or cheque for payment (ask in advance).

Paying your duties is generally the last step before your goods are released to you. Once they are removed from bond, the customs officials use a mysterious red telephone to inform the warehouse/port holding your goods that they have been released by customs. You will then be free to pick up your goods, assuming the other criteria has been met such as paying your freight forwarder any outstanding balances and presenting an Original Bill of Lading.

Should You Use a Customs Broker

If you completed reading this article and are completely put off, then there is one ultimate cheat/hack to having your shipment cleared and released by customs: using a customs broker.

A customs broker will complete all of the necessary paperwork for you without you ever having to leave your living room. The catch, of course, is that you will have to pay anywhere from $100-250 for their services.

I recommend most new importers to use a customs broker on their first shipment as there are a lot of other obstacles to deal with and a customs broker is an inexpensive mentor along the way. However, I also recommend all importers, after a couple of successful imports, to clear customs at least once on their own so they can get a true taste for how the entire process works.

Conclusion

Clearing customs, like international freight, is a often a daunting area because on the surface it seems foreign compared to any processes were used to. However, much like international sea freight, it is not much different than using a post office. Clearing customs is not dissimilar to coming back to airport customs after travelling abroad. Most of all, after a couple of times of going through the process it will become second nature.

As always, if you have any questions or advice, feel free to comment below.

Hi David,

I’ve just came to your great website through Spencer’s podcast, and I immediately subscribed :)

I am doing my first shipment by air, but I’ve come to one obstacle. I am from Europe, and have no one in USA. The shipment is ready to be sent by UPS but UPS is asking me for contact person in US who will clear the goods on the customs.

I have heard from many people who are doing Amazon FBA that didn’t have to do anything while doing Air Express shipment to Amazon. But UPS in my case is strict about that, they can’t offer me any other solution.

I have contacted agents to clear the goods for me, but they are fairly expensive for me and this shipment, as they ask for bond insurance ($450) along with their normal fees.

Could you please advice me with proper solution if you know? This is my first shipment and I wanted it to be as easiest as possible with air shipment, but I guess these kind of problems are normal on the road.

Hi Stefan,

I do not believe UPS will be the importer of record for you as you know. I believe this is the case for most air carriers. I’ve heard of people getting around this by inputting ‘suspect’ information in the IOR field and it seems to get through the cracks sometimes.

$450 seems to be a really high charge for a broker. Does this happen to be Shapiro? I would get quotes from a couple of others- I would think you can find something for much less than this.

Thanks for your response David.

I have managed to settle a deal with different company which does export and import from China and it seems they well solve the Air Express shipment much easier then going with suppliers solution.

Sounds like his shipment fallen under formal customs entry which I heard freight companies cannot clear using their couriers and require to seek importing specialist.

That’s a good point Boris. I believe anything over $2500 requires a formal entry.

Hi guys,

I’ve just paid for my first shipment of 150 small packets of chalk markers from China delivering by air to USA Amazon warehouse.

My China supplier supplies a number of amazonians with this product and none of them have had to use a customs agents or filled a form out. They are using Dhl.

Shipping straight into the warehouse they say they have done it hundreds of times before.

So now I’m wondering who has to fill out a form and who doesn’t. We simply chose product, brand logo, barcoded packed one box ship by air directly into Amazon. Now I’m panicking that I’ve either done it right or I have not. According to the other sellers they did it this way also and had no problems, what’s your take on this please?

Thank you ps. I’m an Australian shipping from China to the USA.

I believe the answer is involved in the cost of the items your are buying. I thought I read that the break out price is $500US….if you exceed $500 you have to pay a customs fee…if lower you can pass thru. Plus it is also the items and proper carrier paperwork. companies like DHL prep your shipment as best as possible as to not get hung up. They are experts too.

You have to pay duties on any commercial merchandise, regardless of value (the issue becomes whether a ‘formal entry’ needs to be entered or not). I suspect either the Chinese Supplier is having DHL bill them for the duties and then billing you (which would be ideal) or they’re clearing the goods at $0 value.

Laws for both countries are very similar and exchange rate is also not so high. So, i think the process of custom clearance between these 2 countries is very easy,

We ordered a promotional item through a local promotions house which was being produced in China. We were expecting delivery next week. Just received an email from the local supplier that the shipment “has been randomly selected by customs for inspection”. The ship is not docking until August 12. Is this normal practice that a shipment is chosen and it hasn’t even landed yet?

Sorry for the late reply – yes, very normal. I wouldn’t sweat it much, but expect at least a couple or few days delay.

Hi David, Thanks for the detailed article on how to import. Luckily I am also from Canada. So the examples used were very relevant. Are you from Alberta too? I noticed you mentioned the 5% GST.

Nope, I’m from Vancouver :)

Hi David,

Thanks so much for this amazing article.

I am importing to the USA from China. I am based in Canada. I am having a hard time finding the custom forms you mention in the article?

Can anyone point me in the right direction?

I would greatly appreciate it

:)

Hi,

Are you referring to the B4? It should be pretty easy to find through the B4. Unfortunately I’m in the China right now and the internet is a dog so I can’t find this for you, but maybe someone else can chime in.

You are very kind to reply and to want to help.

I believe the b4 Form is for importing into Canada, correct?

I am importing into the USA from China. I just live in Canada.

So far my research has shown that I may need the following forms:

– CBP Form 7533

– CBP Form 3461

Is this correct?

Hi Stephen,

Unfortunately for my shipments to the U.S. I always use a customs broker so I can’t be of much help :-(

Which custom broker are you using in USA? I am looking for one to help me clear my vehicle import. You said $100 to $250 they charge but the one I found on google is asking $500 per car.

Might be more for a car.

Do I have to present the paper work physically in person at one of the custom offices in the USA?

I have found a custom broker that is charging $540

Does anyone know of a company that charges less?

This is my first time doing this and its been a definite learning experience :)

Any help, advice or suggestion is appreciated

$540 is a lot, unless that also includes the duties. $150-300 is far more normal. I would contact PCB.ca.

Thanks for the referral

I really appreciate your help David

Hi David,

Yor blog is really helping me,

As a first time importer I am really confused with these questions.

1)I am starting a fashion jewellery business

Through aliexpress. I have bought some samples. That have cost me less than 80$ in each packet( i have been testing products so got samples from 5-6 different suppliers).

As fashion jewellery in inexpensive even if i order in bulk it will cost me less than 1000$ I wish to choose dhl for this.( into usa).

Will dhl handle every thing fine.

Or do I have to do some thing else?

What about if the order exceeds 1000$ what Will be my part?

Thankyou

The de minimis value is $800, meaning anything more than this needs a ‘formal entry’ into the U.S. and costs more money. I’m not sure how DHL handles this, but in general, if you’re close to that $800 threshold, you should try to be just under rather than just over.

You should hire a good canadian custom company like https://clearit.ca for getting the process done asap.

I loved this article super helpful and knowledgeable tips for someone who is a first time importer. If someone ever is needing clearance for a shipment into the US make sure to look up the custom broker’s BorderBuddy.com they helped me out a ton and were very fast.

Hi Dave,

Thanks for the informative website.

I have a quick qn, 2-3 boxes of eyeshadows were shipped over to USA by DHL via a shipping agent in China. The goods are from China. The first batch we sent over via this agent few months ago wasn’t an issue.

However, for the second batch, according to the client in USA, it was seized by the custom without any notice. She rang up DHL USA and they only informed her, she will receive a letter but that was like 10 days ago. We called up DHL and our shipping agent but they seems unhelpful and just said wait for the letter. What do think it’s the issue here and how can our client rectify this issue?

Much appreciate with any of your advise. Thank you.

Random audits by border agents is very normal. It could just be random, there could be a problem with one of the other people’s products that were co-shipped with yours, or there could be a problem with your products. As long as you don’t know of any issues with your products you just have to be patient. Eventually they’ll be released but it can sometimes take up to 30 days.

If I hire a custom broker to clear the goods

Do I still have to go to the custom office?

No you don’t.

Good to know more about how to clear customs. However, thank you for the article you shared!

You’re welcome Russel :)

Thanks for the info, Dave.

I have a related shipping question.

I’m hearing when setting up your shipment plan in seller central not to put the supplier’s (China) address in the “Ship from” but rather put the destination port to get an FBA center closer to the west coast.

The issue is when trying to get a quote from a FF they need a destination address.

Do you yourself use a standard west coast port as your “ship from” in seller central or do you ask your FF for this?

Yes, just enter an address closest to your desired FC as long as you’re not using partnered carriers.

Thanks Dave,

Do you have your supplier palletize your boxes or just ship them loose and have your destination warehouse palletize and label?

Also for the box labels, do you put the suppliers address or the warehouse address if using AMZ carriers for the final leg?

About the half the time we have them palletized in China and the other half the time in the U.S.. Depends on a few factors (mostly how much the supplier complains and/or I trust them to do it correctly). If you’re using AMZ carriers you have to put the address of the pickup point.

Thanks,

Who is your current recommendation for a freight forwarder/customs broker?

(In the past you’ve mentioned using PCB freight)

Have you tried using Freightos to find a FF?

Still PCB :)

Hi Dave, thank you for helpful information you gave to me.

I’m about to import one full 20′ container of unique plumbing staff from China to USA(California), so whats the best way to transfer money to China for goods(about $170.000) ? Thank you.

I’m not sure if it’s $170, $17k or $170k you’re transferring. Relatively speaking though – PayPal, Wire, LOC in that order :) Be careful if sending $170k – lots of risks in that and I don’t want to be held responsible :)

Hi,

My container is being held for an intensive examination. Particularly I have shelves for retail space. Majority of my shelves are being wrapped with another wood board for support and packaging. They are currently asking for documents. If I cannot provide any documents, would it be possible to just tell them that they can throw it away? Thanks.

Hi Jean – you’ll have to check with your broker. I’m not sure if that’s an option in your case.

Hi

I want to import to Canada, I am currently residing in Montreal. I don’t have enough products yet to fill up a whole container since I am only starting out now, do you have any recommendations for shipping methods for smaller amounts of commercial goods?

Yes, LCL :-)

How much maximum time can I get to clear products from US custom for import in USA

Not sure but it’s weeks+. You’ll pay storage though.

Dear David,

I work for a Chinese solar panel distributor as sales manager. we have an American client, he has placed an order of around 8 – 40ft containers of solar panels from our company. he has accepted to pay the anti-dumping tariffs. can you please let me know how he can reduce the anti-dumping tariffs? can you recommend any custom brokers in NewYork who can deal with anti-dumping tariffs and other documentation?

Thank you

Any customs broker can pay these for you. No legal way to reduce them though.

Hi David,

I am looking at importing and exporting goods in Canada. I was doing research on it,and found your article. Really liked btw :)

I am now considering to get my customs broker license to know what really it takes and eventually, be able to do it for myself and clients and partners to import and export.

I think it could be a valuable asset, what do you think?

Regards,

Max

Learning is good- have your license probably doesn’t have much value for your own imports as you can do this without a license.

Informative post and very helpful as well. This post is very helpful for all the startups as well as an established business.

I have no need for a license just to be able to properly clear our own loads 8-12 containers yearly from China to U.S. Can you recommend a training service that will focus on my specific needs vs the industry wide standardized testing…..?

No idea unfortunately.

Hello,

Thanks for sharing your knowledge, it was super interesting to read!

I am having a shipment of less than $800 being shipped by sea from China to USA.

So this means there are no paperwork and customs to take care of or the need for a freight forwarder?

Best,

Al

Hi Dave

We are a company based in South Africa but shipping our products which are suppliments and green tea from the US , which are the procedures to ship them into the country without any challenges or documents needed because our last shipment was detained due to imports and products registration stories.

Regards

Unfortunately I’m not sure of the country specific requirements in South Africa.

Hi Dave,

We are shipping 2 different shipments:

1) Shipment from China to Canada (1,500 USD just delivery and 3,800 door-to-door delivery option) in such case does it worth going with DDP? I have never cleared customs myself and do not have a broker, I am afraid that the sea freight would get to a port other than Toronto and I won’t be able to clear it myself and still have to hire a broker ( I live in Toronto)

2) Air freight shipment to Amazon FBA warehouse from china. Value = 2,000 USD. In such a case do we need to hire a clearing agent, or this might not be necessary as the value of the shipment is low enough? I believe it’s going to be done through UPS.

Dave,

This is a fantastic article and I used it in my quest to import my first set of goods, into the USA. So far, it’s been fairly clean. I had a couple questions for you.

I shipped my goods out of China and the manufacturer managed/setup the LCL ocean shipping. Once it arrived, I received an arrival email from Lavinstar and the freight location is STG Logistics. The freight was 0.5 CFM but weighed 1400 lbs. Does $530 seem like an accurate charge for all of the CFS activities? That seemed really high to me.

Another question I had…to clear customs, do I have to go to the office of the specific port of entry? Or any port of entry in the region (i.e. NY, Buffalo, etc.)? Or any port of entry in the USA?

Thank you for this outstanding article.

Antonio

It is important to note in the USA, if the declared value of the imported goods is $2500+, legally you HAVE to use a broker. $2499 and under you can clear it yourself.