With more people jumping into the ecommerce wagon during the pandemic, more sellers are utilizing ads to get ahead. Because of this, the biggest ecommerce company’s ad revenue spiked to $15.73 billion in 2020, chipping away at Google’s US digital ad shares.

How did this happen and will this trend continue?

Related Podcast: E348: 4 Amazon Advertising Methods and How Much You Should Spend on Them

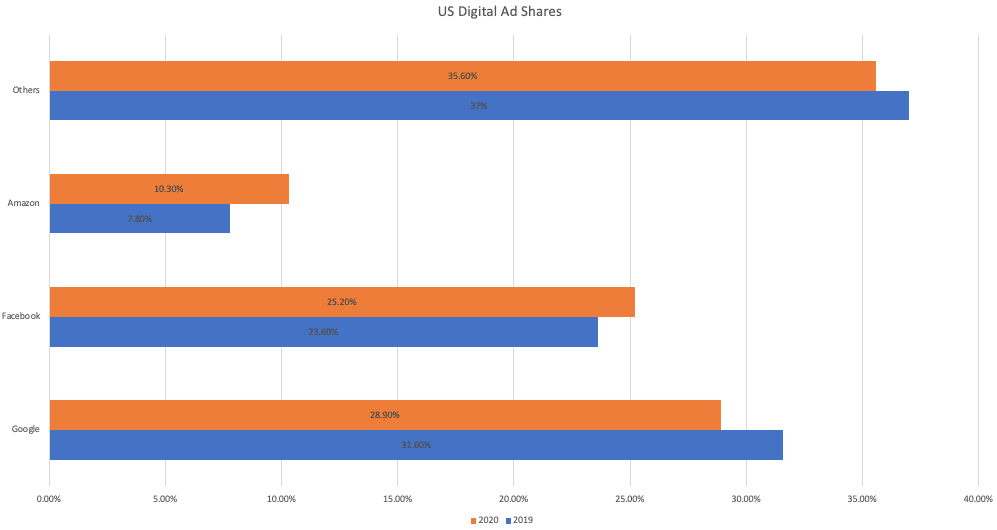

US Digital Ad Shares in 2020

eMarketer reported that Amazon’s 2020 share went from 7.8% to 10.3%, while Google’s went down from 31.6% to 28.9%. Facebook’s share also grew despite Apple’s impending threat to its targeted marketing.

The report was based on the analysis of quantitative and qualitative data from the following:

- Government agencies

- Media firms

- Research firms

- Public companies

- Interviews with top executives at publishers, ad buyers, and agencies

Ad Revenue Breakdown: Amazon vs. Google

To understand the share difference better, we should know where the majority of the ad revenues are coming from.

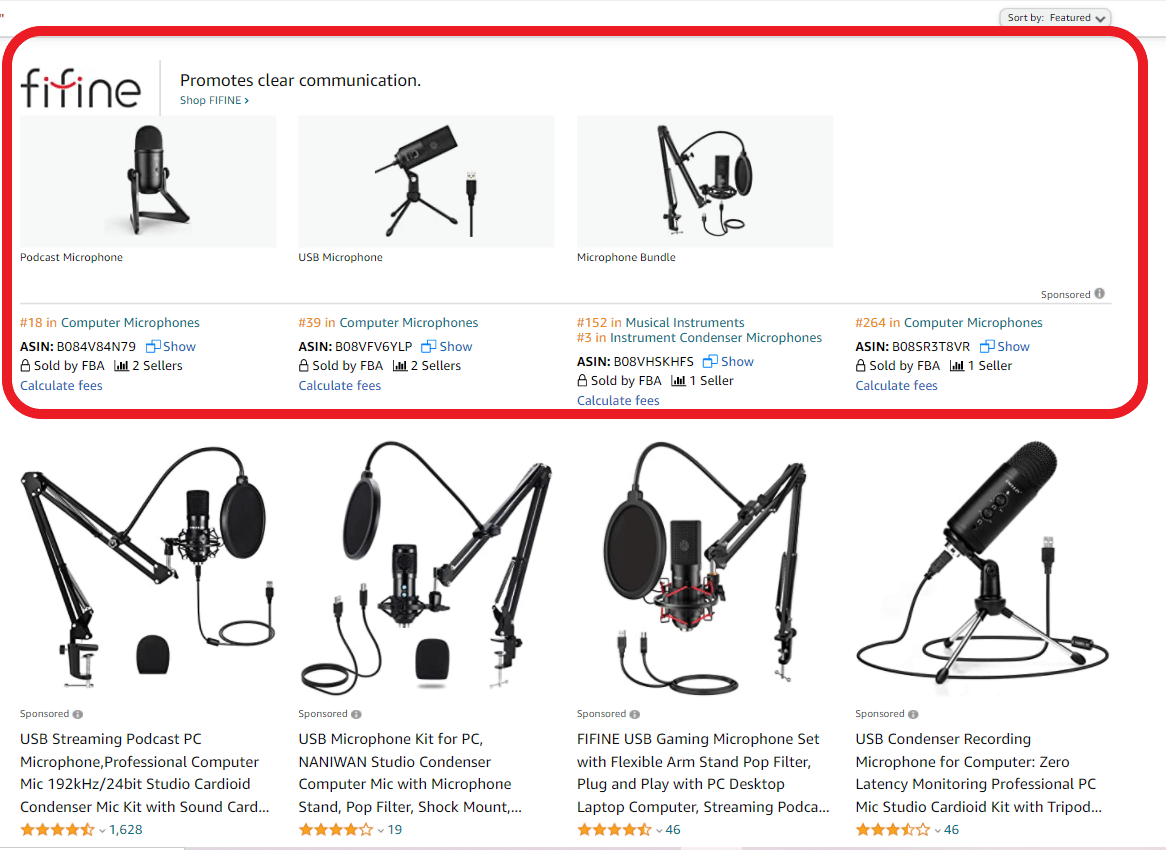

For Amazon, the same eMarketer report revealed that the biggest contributors are two of its PPC ads:

- Sponsored Products

- Sponsored Brands

The other 10% comes from

- Fire TV

- Twitch (now Prime Gaming)

- IMDb TV

- Ads on other platforms

This increase contributed to Amazon’s overall revenue. The company’s projected Q4 2020 revenue was between $112 and $121 billion, but it ended up with $125 billion, a 44% increase from the same period in 2019.

So how about Google?

According to Statista, the majority of Google’s ad revenue comes from search advertising. This hardly comes as a surprise, knowing that it’s the biggest search engine in the world with a 92.18% market share.

Advertising makes up the majority of Google’s overall revenue. Outside of countries such as Russia and China, Google has very few notable competitors when it comes to desktop search traffic.

Will This Trend Continue?

Experts are saying that Amazon will continue to increase its share while Google’s will continue to decrease. In particular, Google’s US digital ads share is expected to decrease to 26.6% by 2023.

Nicole Perrin, an eMarketer analyst, says the trend will continue even in a post-COVID world despite the spike being fueled by the pandemic and the glut of consumer spending as a result.

Other reasons why Amazon will continue to increase its share are the following:

- Google is a general search engine where people search for everything from informational searches, i.e. “What’s the population of Brazil?” to product searches “Best camping tent.” Amazon, on the other hand, is a buyer-centric platform that’s more appetizing to many advertisers..

- Apple is planning to develop its own search engine that can compete with Google.

- Amazon advertisers can access data regarding consumer behavior, targeted advertising, and purchase in real time.

What Does This Mean for Sellers?

If you’re an Amazon seller, chances are you’re already using PPC campaigns to help your products rank better. As Amazon’s share of digital ad sales increases, this, unfortunately, may mean that ad costs on Amazon will rise.

If PPC costs rise, that means the value of natural organic rankings on Amazon will become even more valuable. A refocus on optimizing your listings can help your conversion rate and subsequently, rankings.

Conclusion

When it comes to US digital ads, Amazon continues to increase its share in the pie, and this appears to continue in the coming years. It still has a long way to go, however. It didn’t exactly surpass Google even with the spike. It just solidified its spot as the third-placer.

What other implications do you see with this trend? Let us know in the comments.