Amazon Sales Tax For Sellers in 2023

Let me start this by saying I am not a tax accountant. I’ve never dreamt of being a tax accountant. And I’ve never played one on TV, or in a high school musical.

So, it goes without saying, despite what you’ll read in this article, you should always consult a qualified CPA in your state when it comes to your businesses tax obligations.

Preferably one who understands sales tax as it relates to online sellers because those laws are constantly evolving and differ state by state.

Related Listening: E260: E-commerce Accounting Essentials for Online Sellers

That said, the aim of this post is to bring some clarity to state sales tax as it applies to Amazon sellers in 2020. Things can change very quickly when it comes to anything tax-related, so again, always consult a CPA.

If your business sells on Amazon but you also sell through your own store, the story gets even more complicated and I'll address that at the end.

There’s a lot of confusing, outdated information on the internet when it comes to state sales tax and Amazon sellers. Worse, many of the top-ranking articles on Google are written by companies selling you their tax-filing services and they may be just slightly biased.

So, without further finger point at some poorly written blog posts and companies whose best interest is that you pay sales tax, here’s the EcomCrew low down on sales tax.

Related Reading: I Worked At An Amazon Warehouse for a Week. Here’s What I Learned.

Contents

A Short History Of Sales Tax On Amazon

Before 2018, there was a lot of confusion/disagreement about where the burden lay when it came to state sales tax and Amazon sellers.

Amazon insisted it was on the sellers.

Sellers pointed to the fact Amazon owned the customer and owned the physical locations (FBA warehouses) in each state. So hey, nothing to do with us!

And none of it was made any clearer by the fact states were still using woefully out-of-date laws enacted way before the internet even existed.

Because most sales tax laws were set up to tax physical locations selling within a state, remote sellers simply fell through the cracks (e.g. your business is registered in CA but you’re shipping to customers in AZ, so how on earth is Arizona going to tax you?)

To combat this, states began to fall back on an old law called sales tax nexus.

What Is Sales Tax Nexus?

The sales tax nexus creates a connection between remote sellers and states, so that if they tick certain boxes they’re then required to register, collect, and remit sales tax on sales made in that state.

One example is physical nexus, which can be triggered by a business having a physical presence in that sale (e.g. an office) or even by a remote seller storing inventory in that state.

You may trigger physical nexus if you store inventory in one of the states Amazon has warehouses in. And those are a lot of states. See a complete list of Amazon warehouses here.

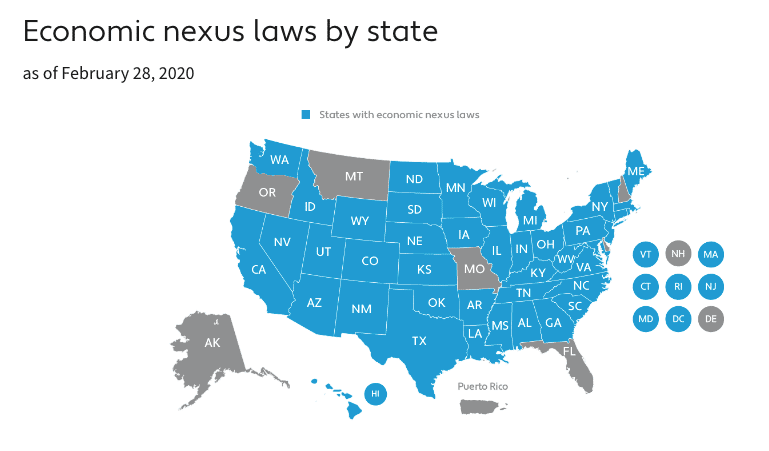

Another is economic nexus, triggered when a seller makes sales over a certain threshold. It’s normally around low to mid 5 figures of sales to a specific state but it varies vastly by state.

You can read all about sales tax nexus here.

Sales tax nexus proved very hard to enforce though when it came to the millions of smaller sellers selling on Amazon.

And, to make it even more confusing, Amazon moved seller inventory from one state to another, from FBA warehouse to FBA warehouse, at will.

Thankfully, all that began to change in 2018, when the first US states began to implement Marketplace Facilitator Legislation.

But I Only Ever Send Inventory to A Couple of States!

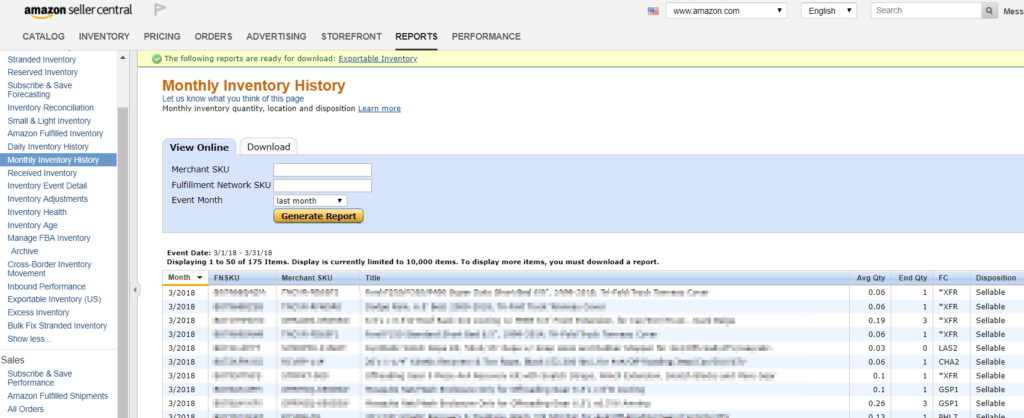

Even though you may physically only ever send inventory to one state when you're creating shipment plans, Amazon has something called distributed inventory.

When you ship products into Amazon FBA warehouses, Amazon then re-distributes those products across the country. So even though you may only ship products to one state or a handful of states, Amazon will redistribute your products across many other states. If you want to see where your inventory is currently stored, go to Seller Central and go to Reports -> Fulfillment -> Monthly Inventory history.

When you view this report, you will likely find your inventory is stored in far more states than you actually ship products to. In each of those states, you have now created nexus for your company. Amazon has warehouses in dozens of states and they can move your inventory around at will so this is the real complicating factor. Amazon is essentially creating nexus for you and your company at will. Amazon will likely not move your inventory to all of the states it has warehouses in and not all states have state sales tax but regardless you will have nexus in a lot of states.

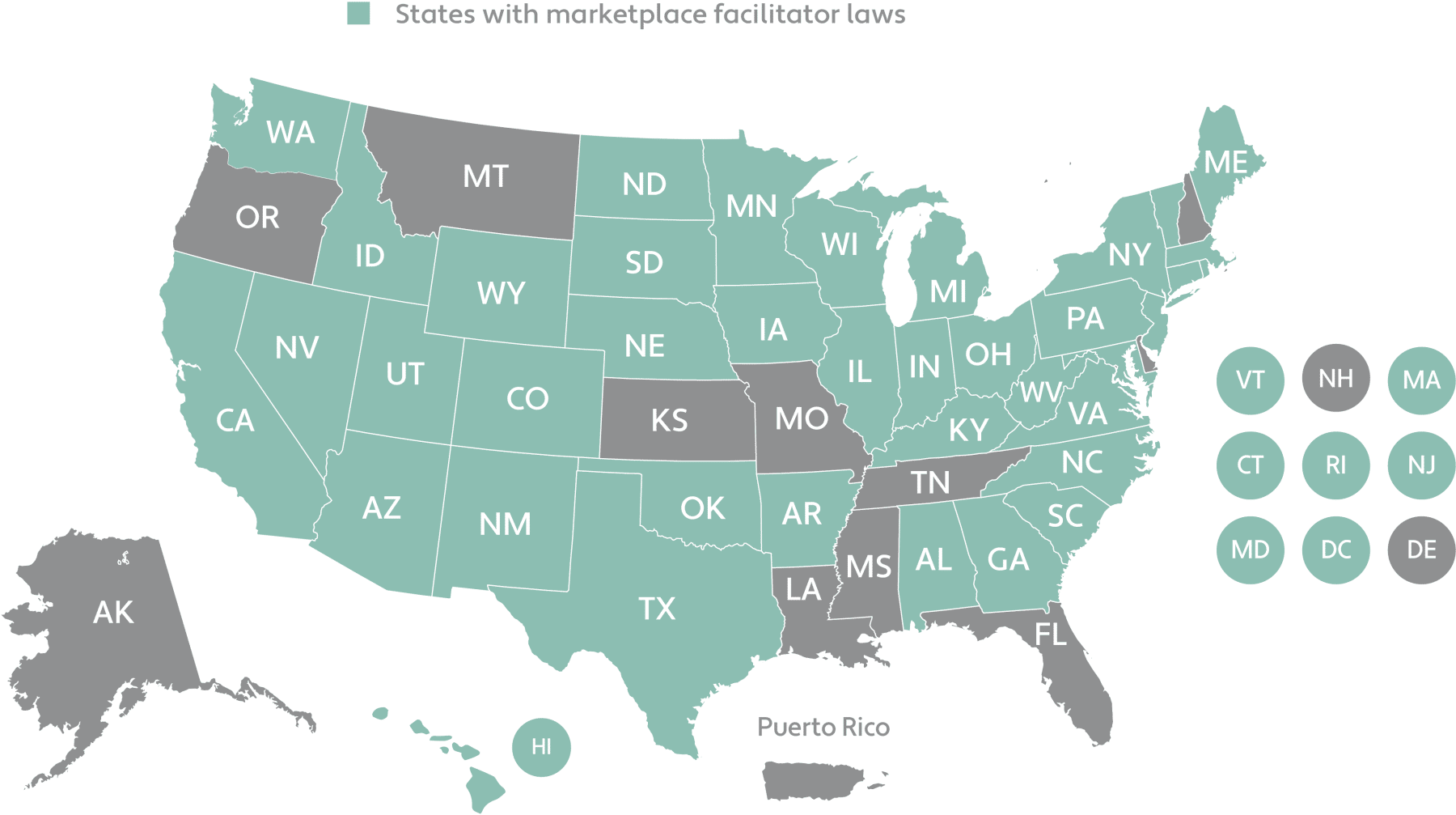

What’s Marketplace Facilitator Legislation?

Marketplace Facilitator legislation was a set of laws that shifted the sales tax collection and remittance obligations from third-party sellers (i.e. Amazon sellers) to the marketplace facilitator (i.e. Amazon).

Starting with Washington State in January 2018, Amazon slowly began to be legally held responsible to calculate, collect, remit, and refund state sales tax on sales sold by third-party sellers for transactions destined to states where Marketplace Facilitator and/or Marketplace collection legislation was enacted.

As I write this, 39 states now have Marketplace Facilitator legislation.

Three of those – Colorado, Illinois, and Washington – have some weird rules that mean things aren’t quite so cut and dry for sellers (more on those later).

But the other 36 put the responsibility of calculating, collecting and remitting sales tax on behalf of remote sellers firmly on Amazon’s shoulders.

Five states, New Hampshire, Oregon, Montana, Alaska and Delaware (aka NOMAD) don’t have sales tax. So no need for sellers to worry about those.

So those 5 plus the 39 states with Marketplace Facilitator legislation make 44 states.

Leaving just 6 states where sellers still need to file sales tax IF they fall under sales tax nexus.

So let’s look at each state and see where sales tax MIGHT be a seller’s responsibility, as it stands in mid-March 2020.

Amazon Sales Tax State By State

The 44 States with Marketplace Facilitator Legislation

- Alabama

- Arizona

- Alaska (no sales tax)

- Arkansas

- California

- Connecticut

- Delaware (no sales tax)

- Georgia (starts April 1st, 2020)

- Hawaii

- Idaho

- Indiana

- Iowa

- Kentucky

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Montana (no sales tax)

- Nebraska

- Nevada

- New Hampshire (no sales tax)

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon (no sales tax)

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

The 3 States With Marketplace Facilitator Legislation Where Amazon Sellers MAY Still Have To Pay Sales Tax:

Colorado

Colorado enacted Marketplace Facilitator legislation in October 2019.

However, they also have a thing called “Home Rule City Sales Tax” that isn’t covered by that legislation, and so must be paid by sellers.

This is because Colorado is a ‘Home Rule State.’ That means they give flexibility to the municipal governments within the state to override certain laws at a state level and make their own law, e.g. the amount of sales tax they charge.

There are 73 such cities in Colorado that have their own sales tax laws.

This makes it super freakin confusing, so my advice would be to speak to a CPA.

Illinois

Amazon started collecting sales tax on behalf of sellers in Illinois on January 1st, 2020.

However, there’s also a little thing in Illinois called Retailers Occupation Tax, or ROT.

As soon as Illinois’ marketplace facilitator legislation kicked in on Jan 1st, Amazon stopped collecting and paying sales tax AND ROT and passed the burden of collecting ROT onto sellers.

According to taxjar.com:

“Sellers fall into three categories which determine their collection requirements:

- Remote seller with economic nexus only*: Sellers are subject to the combined state and local ROT at the purchaser’s location (*Illinois’ threshold is $100,000 or 200 sales over a 12-month period).

- Remote seller with a physical presence due to inventory:

Sellers are subject to ROT on sales where the “ship from” location is within Illinois. Shipments from outside of Illinois into the state collect the use tax* only (*Amazon pays this). - In-state seller: Sellers charge the combined state and local ROT at the brick-and-mortar location.”

So even if you’re a remote seller and you’re doing less than $100,000 in sales or 200 units in Illinois in any 12-month period, you’re still liable for collecting ROT if any of your units have a “ship from” address within Illinois, i.e. from an FBA warehouse in Illinois.

Washington State

Although Washington State passed a Marketplace Facilitator law that came into effect on January 1st, 2018, they also have a separate Business & Occupation Tax (B&O).

Physical nexus is triggered in Washington State if you have any inventory in an FBA warehouse in the state… and any seller with physical nexus MUST still pay B&O.

This is a very complex subject that could be its own blog post, so if you want to read up on what you need to do when it comes to paying Washington State B&O, I’d recommend checking out this detailed post on taxjar.com.

What States Doesn't Amazon Have Warehouses In?

Amazon has warehouses in most states, but not all. This can have important physical nexus implications.

Here are the states in that Amazon does not currently have warehouses.

- Alaska

- Arkansas

- Hawaii

- Louisiana

- Maine

- Montana

- Nebraska

- New Mexico

- North Dakota

- Rhode Island

- South Dakota

- Vermont

- West Virginia

- Wyoming

The 6 States Without Marketplace Facilitator Laws

Florida

Florida has proposed marketplace facilitator legislation that will take effect on October 1st, 2020.

Any business with physical nexus in Florida – a retail store, warehouse, inventory, or the regular presence of travelling salespeople or representatives – triggers a sales tax collection obligation in the state.

Inventory is the key one here for the majority of Amazon sellers, so if you have inventory in a Florida FBA warehouse, you may be liable to collect, pay, and remit Florida sales tax.

Florida currently has no economic nexus law but a proposed one may take effect on July 1. So if you sell in Florida but have no physical presence there, keep an eye on that one to check you don’t exceed the thresholds.

Kansas

Storing property for sale in the state, including merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Kansas in a warehouse owned or operated by Amazon, automatically triggers Kansas physical nexus laws.

So if you have inventory in an FBA warehouse in Kansas, you should be registering to pay sales tax there.

Also, according to the Kansas Department of revenue, they started enforcing economic nexus for remote sellers who have no physical presence in October 2019.

However, as they stipulated no minimum $ threshold on sales, the Kansas Attorney General determined the Kansas Department of Revenue lacks the authority to tax remote sales without providing safe harbor for small sellers.

The Kansas Department of Revenue disagrees, saying it cannot select the laws it enforces. In other words, these are confusing times for small remote sellers.

If you listen to the Kansas Attorney General, and you have no physical presence in Kansas, you’re good.

But if you listen to The Kansas Department of Revenue, even if you have no physical presence, if you sell even one single unit in Kansas you’re required to register to collect and remit sales tax.

Louisiana

On January 29th this year, the Louisiana Supreme Court held that Jefferson Parrish couldn’t hold Walmart.com liable to collect and remit sales tax on transactions made by third-party sellers through their online.

Or, to put it another way, Louisiana ain’t passed no marketplace facilitator legislation yet. And there’s no sign of when they will.

According to tax compliance firm Avalara, “Businesses are required to register with the Louisiana Department of Revenue and to charge, collect, and remit the appropriate tax when they have a physical presence in Louisiana, such as a retail store, warehouse, inventory, or the regular presence of travelling salespeople or representatives trigger a sales tax collection obligation in the state.”

As with Florida, ‘inventory’ in an FBA warehouse in Louisiana is the main one Amazon sellers that live outside of Louisiana and have no physical presence there (e.g. an office) need to be aware of.

Louisiana will also be enforcing economic nexus laws for sellers outside of the state no later than July 1st, 2020, with a threshold of $100,000 in sales or 200 sales during a period of 12 months.

So if you check any of those boxes you may want to speak to a CPA.

Mississippi

Since 2018, Mississippi has had an economic nexus of $250,000 in 12 months. Unlike other states, they have “or x number of units sold” provision.

They also have a physical nexus that includes inventory stored in their state (i.e. at an FBA warehouse).

If you have inventory stored in the state you’re required to register with them and collect and pay sales tax. But if you don’t, and you’re not selling over $250,000, you’re good.

Missouri

To date, Missouri has no economic nexus laws, but like all the other states listed above, they do have physical nexus triggered by inventory in an FBA warehouse.

So even if you have one unit sitting in an FBA warehouse there, you should be registering to pay sales tax.

Tennessee

As of July 1, 2019, Tennessee brought in economic nexus laws with a 12-period threshold of $500,000.

However, just like all the other states above that don’t have marketplace facilitator legislation, you got it, physical nexus is triggered by having inventory in an FBA warehouse in their state:

“Storing property for sale in the state. This includes merchandise owned by Fulfillment by Amazon (FBA) merchants and stored in Tennessee a warehouse owned or operated by Amazon.”

So if you have any inventory sitting in an FBA warehouse in Tennessee, you have to register for and pay sales tax.

I Sell on Amazon AND Other Channels Like My Own Website. What Do I Do?

Many people sell on Amazon and other channels like their own Shopify store. What does that mean for you if you fall into that bucket?

If you have physical nexus in a state and make a sale in the state through your own website, Amazon is obviously not collecting sales tax for you and remitting it. This means that you’re probably liable to pay it.

If you have economic nexus in a state (and if you’re a 7 figure seller you probably do in many states) and make a sale in the state through your own website, Amazon is obviously not collecting sales tax for you and remitting it. This means that you’re probably liable to pay it.

Given the complexity, some sellers have actually elected to create separate companies for their non-Amazon sales.

List of Taxing Authority Per State

If you’re operating or selling in the United States, you may have to contact the taxing authority of the state you’re involved with. Here’s a list with the links included. We also included links to blogs about resale certificates for each state from TaxJar.

A resale certificate, a.k.a. tax exemption certificate, is proof that you are buying products to resell or are using them as components for products you will ultimately resell. This may help you avoid local sales taxes.

Conclusion

Sticking your head in the sand used to be an option when it came to paying sales tax on items you sold on Amazon.

But moving forward, states that don’t have marketplace facilitator laws, or do but have weird additional taxes that aren’t paid by Amazon, are likely to be far more aggressive when chasing Amazon sellers for taxes owed.

They understand online marketplaces far better now. And they want their pound of flesh.

Registering for, and filing all of these taxes is undeniably a pain in the a$$, but my advice would be if you’re serious about building a brand, speak to a qualified CPA about all of your sales tax obligations, including the additional laws in Colorado, Washington State, and Illinois.

Hi, do know someone who can help me to get ungatet “toys”?

Amazon :)

Hi! Thank you for this post, it’s very helpful.

I’m a new Amazon seller and sales tax is very new to me, so just to confirm: due to Marketplace facilitator legislation, Amazon will be responsible to collect and remit sales tax in those states where these laws apply. As a seller, even if I have physical nexus in some of these states (I.e. home state or states where our inventory is located with FBA), I don’t need to do anything (not even to register for a sellers permit). Is this right?

I’m confused because seller forums say to register on your home state only, while tax platforms say to also enroll in states where your fba inventory is located (which could be in some many states)

Some guidance here would be really appreciated!

Thank you

So, why did Amazon decide to start collecting sales tax after fighting it for so many years: Because they realized that they could make billions of dollars in profits by doing so. Besides charging 2.9% to collect and pay sales tax for sellers– Amazon ALSO adds sales tax to the total sales price BEFORE charging Seller fees.The average seller fee is 15%. So each time a seller makes a sale, Amazon adds the sales tax then charges the Seller fee on the total sales including the sales tax. No wonder they suddenly decided to take on sales Tax!!